Don’t fear the bear

“You make most of your money in a bear market, you just don’t realize it at the time.”

Shelby Davis – Investor and Philanthropist

Bears are creatures that most of us would agree are best avoided, for unlike Paddington, who is partial to the odd Marmalade sandwich, most real-life bears would happily make a meal out of any human that strayed too close. Thankfully, although scary, Bears in financial markets are not to be feared.

But what does a Bear actually mean in the context of financial markets? Although no universally agreed definition exists, its widely accepted that a Bear market represents a price decrease of more than 20% relative to a previous peak. And why do we use the terminology “Bear” as opposed to something less intimidating? Well, this is attributed to how Bears attack their prey, swiping their paws downwards; and when markets are on the up, we name them Bulls, as Bulls thrust their horns up while attacking. Markets cycle between Bear and Bull markets but over the long run, there is only one direction that financial markets head: up!

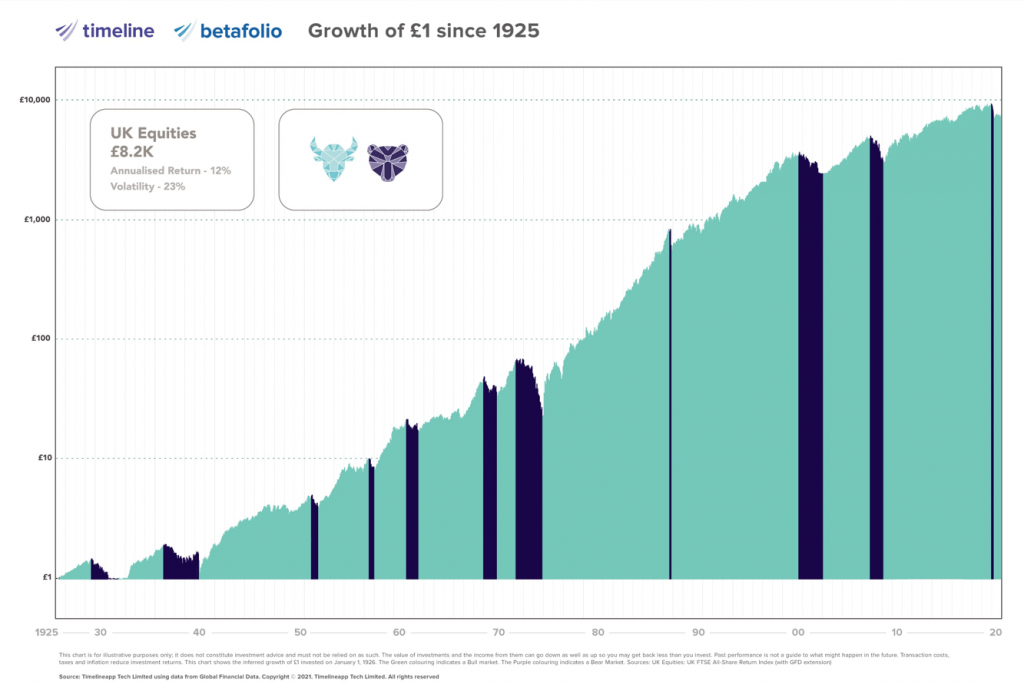

Source: Timeline (2021)

Of course, a 20%+ decrease in a portfolio’s value would cause even the most seasoned investor some anxiety. It’s only natural to become unnerved when financial markets start to drop, and the 24 hour news media predicts nothing but financial Armageddon. However, it’s not the Bear market that will have the greatest impact on the long-term return of a portfolio, rather it’s the actions that investors take during the Bear market that have the greatest impact.

During a Bear market, less disciplined investors, seeing the value of their investment fall, will be tempted to throw in the towel, to cut their losses. In fact, this is quite possibly the worst course of action. By doing so the investor locks in those losses and misses the inevitable market rebound. To make matters worse, an undisciplined investor having sold out during the Bear market will be buoyed by the subsequent Bull market and re-invest. An investment strategy based on selling low and buying high is not a sound strategy!

Arguably, the hardest part for those investing over the long term is accepting that things will not always be plain sailing; Bears are as natural to the forests as they are to financial markets. What’s more, despite the claims of some, we cannot predict when they will occur, what will cause them, the magnitude of the downturn or the time taken for the market to recover. The chart below serves to illustrate these points.

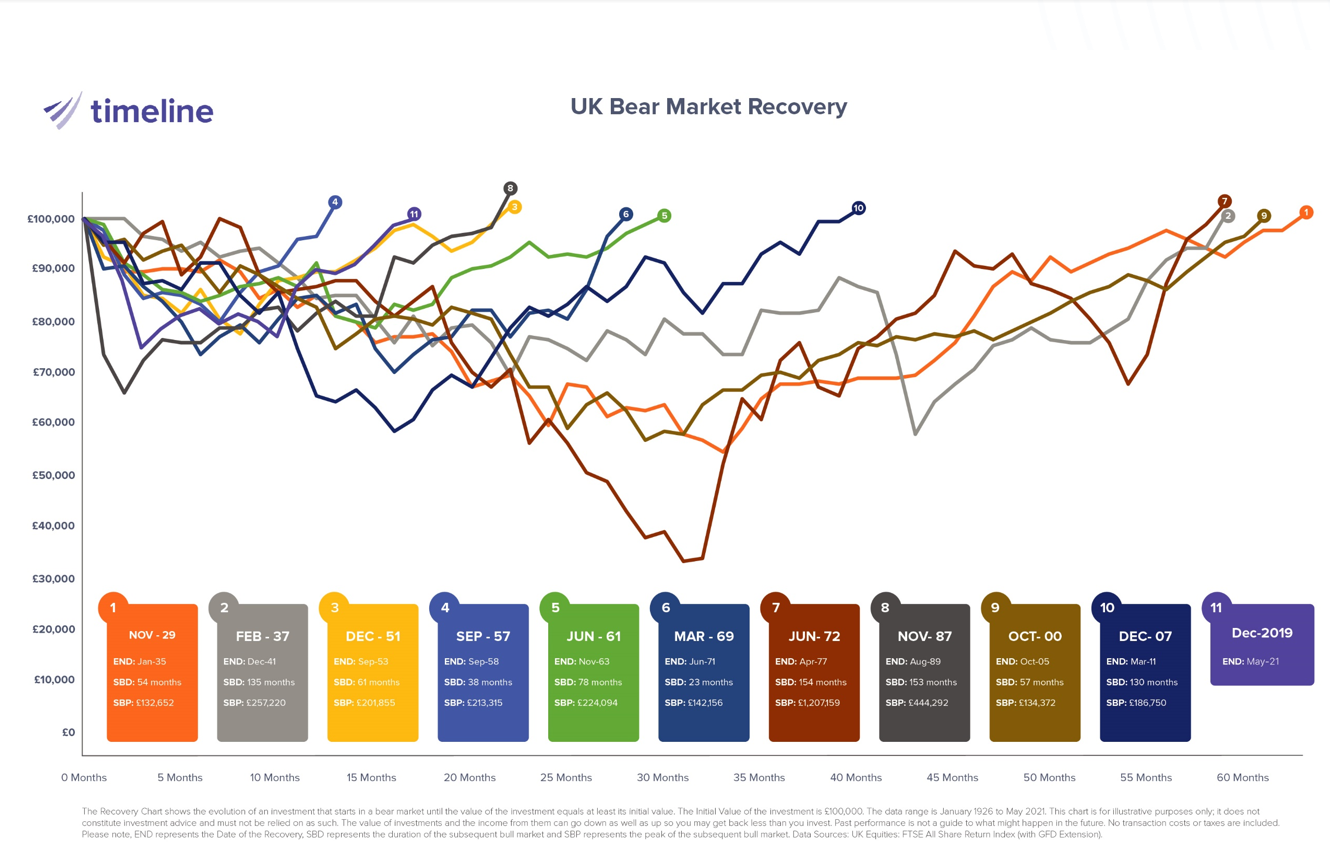

As we can see below, over the last 100 years the UK market has endured no less than eleven Bear markets with initial causes ranging from the Great Depression in 1929 to the Dot-com bubble in 2000. What’s striking is the different duration of each Bear market, the path to recover and the time taken for that recovery; each Bear market has been truly unique. Nevertheless, we can take solace in recognising that markets always do recover.

Source: Timeline (2021)

What’s more this chart serves to illustrate the importance of remaining invested, even when things look bleak. Let’s examine the deepest and one of the longest UK Bear markets, which started in June 1972 and lasted 58 months. An initial investment of £100,000 made at the start of that market downturn would have fallen by almost 70%, arguably, holding one’s nerve when exposed to such losses would be a difficult task. But remaining invested would have allowed the investor to capture the subsequent 154 months Bull market and would have seen their investment grow to £1,207,159!

In summary, while financial Bears are by no means as innocuous as the marmalade loving Paddington, akin to their wild counterparts, if investors understand their nature and give them the respect they deserve, they need not be feared. Smart investors know that both Bears and Bulls exist naturally in financial markets. Although the Bear has appeared grumpily from hibernation, powerfully swiping at the financial markets on numerous occasions, the Bear inevitably becomes weary, allowing the Bull to re-establish itself as the dominant force over the long-term.

Asset Class Returns

And here we go…

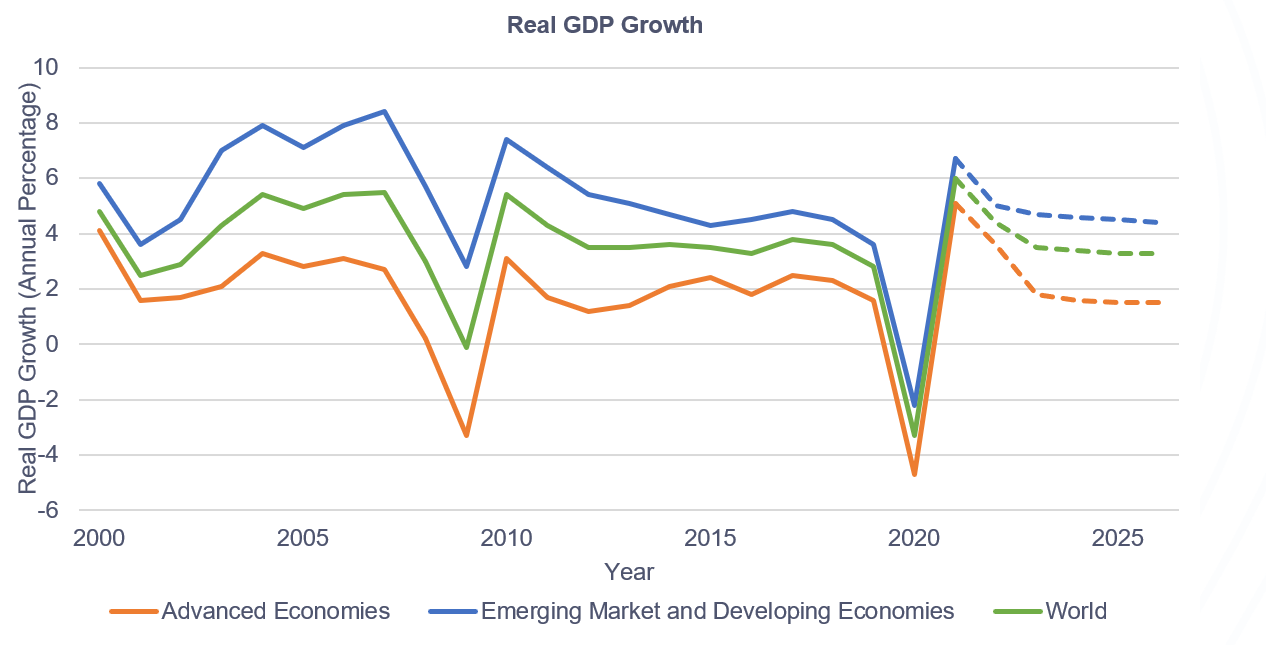

The second quarter of 2021 saw a continuation of the global economic rebound which started soon after the initial shock caused by the pandemic early last year. In fact, no longer recovering, the global economy appears to be transitioning from a Bear market into a new Bull market. The sharp decline followed by an equally sharp and sustained rise, within just eighteen months means we have observed the sharpest V-shaped economic recovery in history.

Source: IMF (2021)

Vaccinations are a pre-requisite for the full re-opening of economies and as expected the richer, more developed nations are leading the charge. However, even across the developed world, vaccination rates vary hugely. As of the end of June, the UK had fully vaccinated 49.6% of the population, the USA 47.2%, France 31.4%, Germany 37.3% and lagging far behind, Japan with 12.4% (Our World Data (2021)). The importance of vaccination is highlighted by Japan, whose recovery has been hampered by local lockdowns (BBC (2021)) in response to outbreaks of the virus.

The US is still driving the world recovery, with US equities returning 7.5% over the quarter (MSCI USA: 01/04/2021-30/06/2021). The IMF has forecast that the US economy will grow by 7% this year, up from a forecast of 4.6% made in April (IMF (2021)). This would be the fastest growth in the US economy since 1984.

The projection was made on the assumption that President Biden’s American Jobs Plan and American Families Plan, stimulus packages worth $2.8 trillion together with other spending and tax reforms, will be passed by Congress. The Congressional Budget Office (CBO) made a similar prediction for growth in 2021 of 7.4% (The Congressional Budget Office (CBO) 2021) but interestingly based this only on current laws. Either prediction is great news for not only the US economy but also the world, as America is still the engine that drives the world economy.

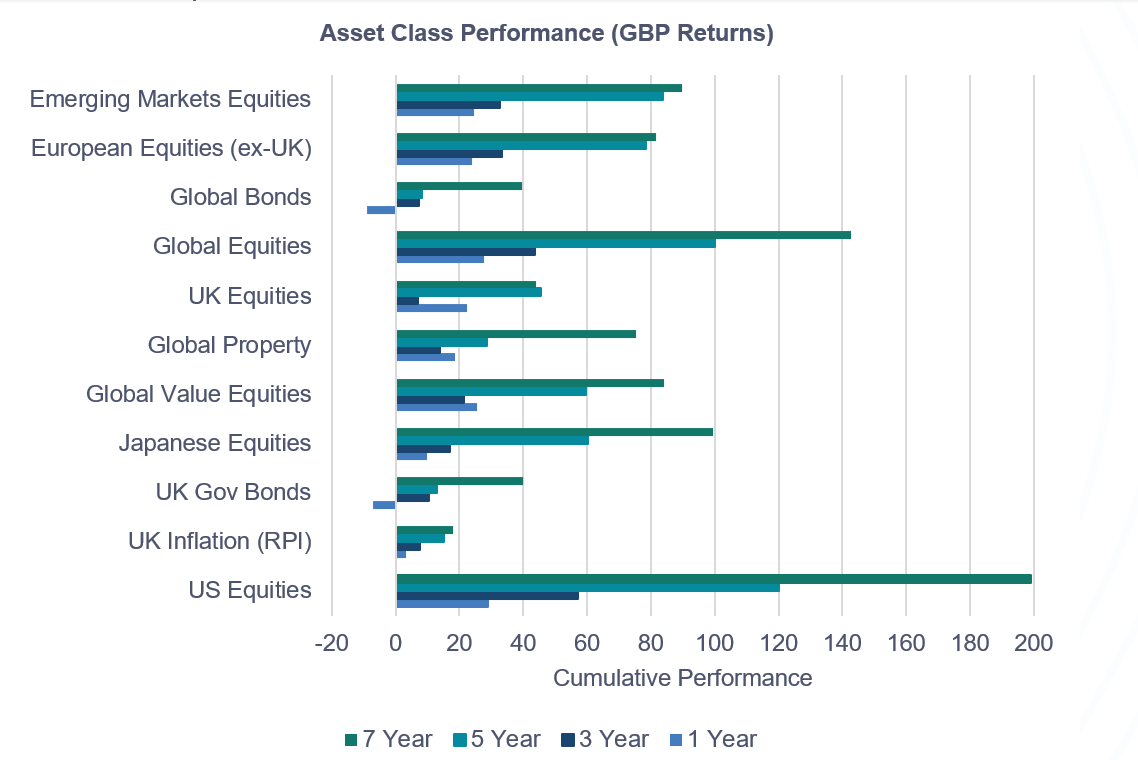

Source: FE Analytics (2021) (Global Bonds: Bloomberg Barclays Global Aggregate, UK Gov Bond: Bloomberg Barclays Global Aggregate UK Government Float Adjusted, UK Equities: FTSE All Share, Global Property: FTSE EPRA Nareit Global, Emerging Markets Equity: MSCI Emerging Markets, EU Equities (ex-UK): MSCI Europe ex UK, Japanese Equities: MSCI Japan, US Equities: MSCI USA, Global Value Equities: MSCI World Small Value, Global Equities: FTSE Global All Cap, UK Inflation (RPI): UK Retail Price Index).

While the Eurozone has lagged the recovery seen in the US due to persistent lockdowns and a slow vaccination programme, European markets appeared to be very much on the up, with equities returning 7.2% (MSCI Europe ex-UK: 01/04/2021-30/06/2021) over the quarter. Moreover, investors have a number of reasons to be optimistic that the Eurozone can maintain this rebound.

Firstly, Eurozone manufacturing expanded in June at its fastest rate since records began in 1997 (IHS Markit (2021)), suggesting a rapid growth in business activity. Secondly, in late mid June the EU signed off its largest ever stimulus package, the €800 billion Next Generation EU (NGEU) fund, designed to turbocharge the blocs’ recovery. Lastly, the European Central Bank (ECB) revised its 2021 economic growth forecasts upwards, from 4% to 4.6% (European Parliament (2021)). All this suggests the Eurozone, like the US is on the road for a sustained recovery.

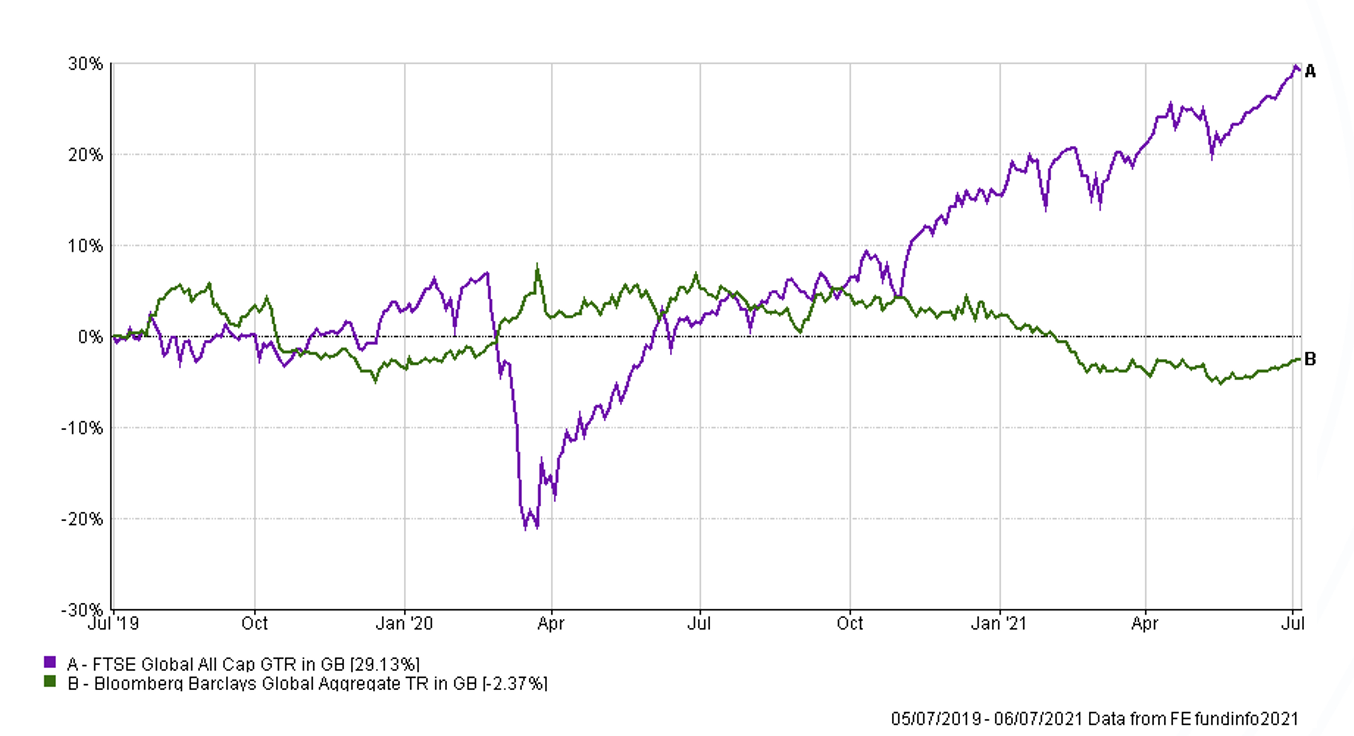

So, it would seem, good news all-round? Well, not exactly, while equites have recovered strongly, bond returns over the 1-year period have been negative; with global bonds returning -6.9% (Bloomberg Barclays Global Aggregate Index) and UK government bonds returning -8.2% (Bloomberg Barclays Global Aggregate UK Government Index). Admittedly, bonds have never been the coolest part of investments but their importance in a well-balanced portfolio is widely acknowledged. Equities are there to drive returns and bonds are there to provide a cushion, as they did in 2020, when times got bad.

Source: FE Analytics (2021)

Unsurprisingly, bonds have not kept up with the rebound of equities as we would expect. The majority of the negative performance over the last year is restricted to the beginning of 2021. Essentially, we are back to where we were before the pandemic hit. Policies introduced by central banks and governments to assist economic recovery such as low interest rates and stimulus packages have put downward pressure on bond yields (returns).

While overall the world economy appears to be well on the mend, based largely on the strong rebounds from a few major economies, not all countries have yet to fully recover. Many emerging economies continue to struggle with the pandemic with low vaccine rollouts caused by vaccine hesitancy, supply issues and logistical problems with distribution. China is a notable exception, despite a slow vaccine rollout, strict measures to control outbreaks have been effective and economic growth is projected to reach 8.5% (OECD (2021)) in 2021.

Despite the disparity of the economic recoveries between developed and developing countries, the OECD expects global GDP to rise 5.8% this year, up from the December 2020 forecast of 4.2%; this would be the highest rate of world economic growth since 1973 (OECD (2021)).

Inflation on the up?

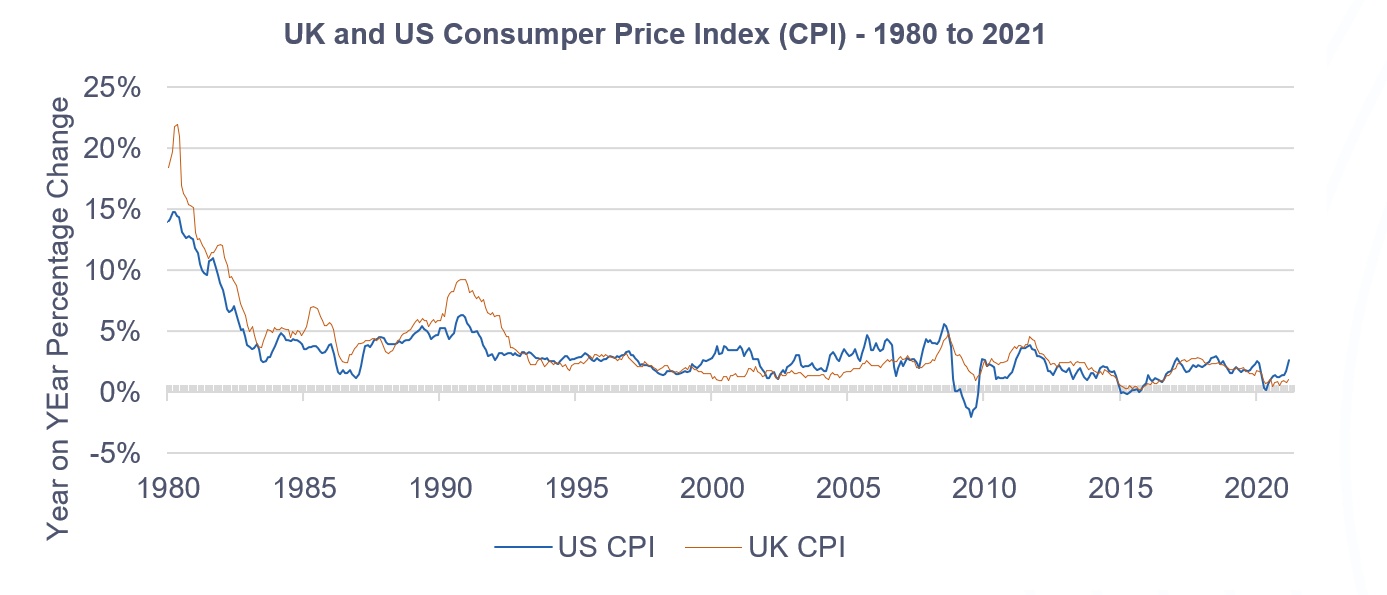

Despite a reassuring second quarter and an encouraging outlook there is one economic indicator that is causing some concern: inflation. Why should investors be concerned about inflation? Well, inflation is the ultimate tax, taking away the buying power of money. Inflation is of a particular concern to investors that hold fixed income investments that are not indexed to inflation. As inflation rises the fixed payments received can buy less and less. This highlights the importance of maintaining a diversified multi-asset investment portfolio.

Inflation is currently rising in those markets which have seen the fastest economic recovery. For example, in the US, inflation hit 5% (U.S. Bureau Of Labor Statistics (2021)) and 2.1% (Office for National Statistics (2021)) in the UK as of May with predictions of further increases over the coming year. These rises stem from a combination of the base effect; whereby the rate of inflation fell to a low level during the lockdowns of last year together with temporary supply bottlenecks. The consensus amongst Central Banks thus far is that the spike in inflation is transitionary and given recent events not unexpected. Indeed, the Governor of the bank of England, noted in a recent Mansion House speech:

“It is important not to over-react to temporarily strong growth and inflation, to ensure that the recovery is not undermined by a premature tightening in monetary conditions. But it is also important that we watch the outlook for inflation very carefully.” Andrew Bailey, Governor of the Bank of England (2021) (Bank of England (2021))

Reviewing long-term UK and US inflation data, adds support to the Governor’s position on inflation. While current inflation is elevated, over the last 30 years, historical data shows that even during periods of low inflation, spikes of inflation have occurred and have proved to be transitionary.

Source: Federal Reserve Economic Data (2021)

Portfolio Performance

(All data is up to last price –30 June 2021. Past performance is no guarantee of future return. Data sourced from Morningstar API. Careful consideration has been taken to ensure that the information is correct but it neither warrants, represents nor guarantees the contents of the information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Percentages may not total 100 due to rounding. Performance Periods: 1 Year: 30/06/2020-30/06/2021; 3 Year: 30/06/2018-30/06/2021, 5 Year: 30/06/2016-30/06/2021, 7 Year: 30/06/2014-30/06/2021. Additional performance periods may be accessed with the help of your adviser via the Betafolio Control Centre: https://app.betafolio.co.uk/)

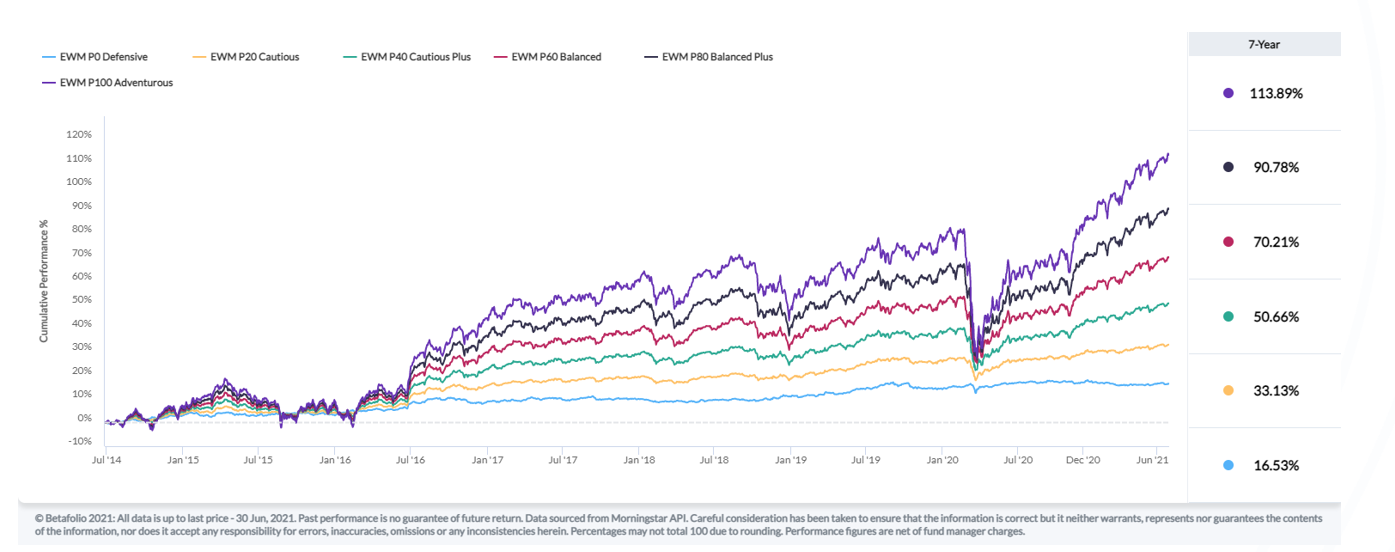

Expert Wealth Cumulative Gross Performance

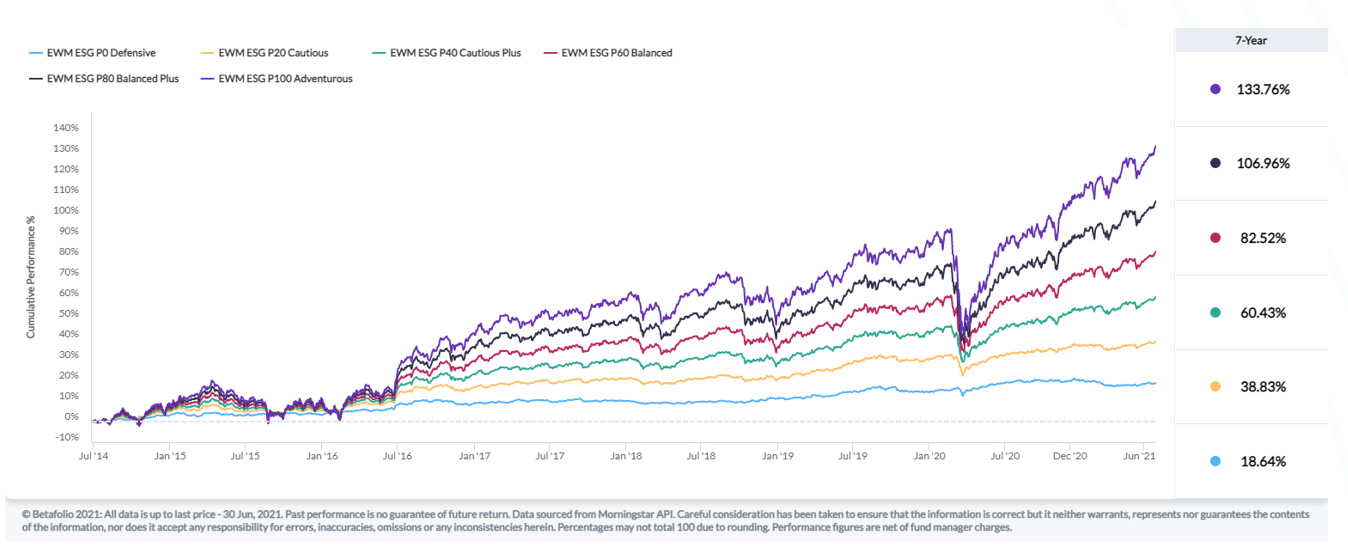

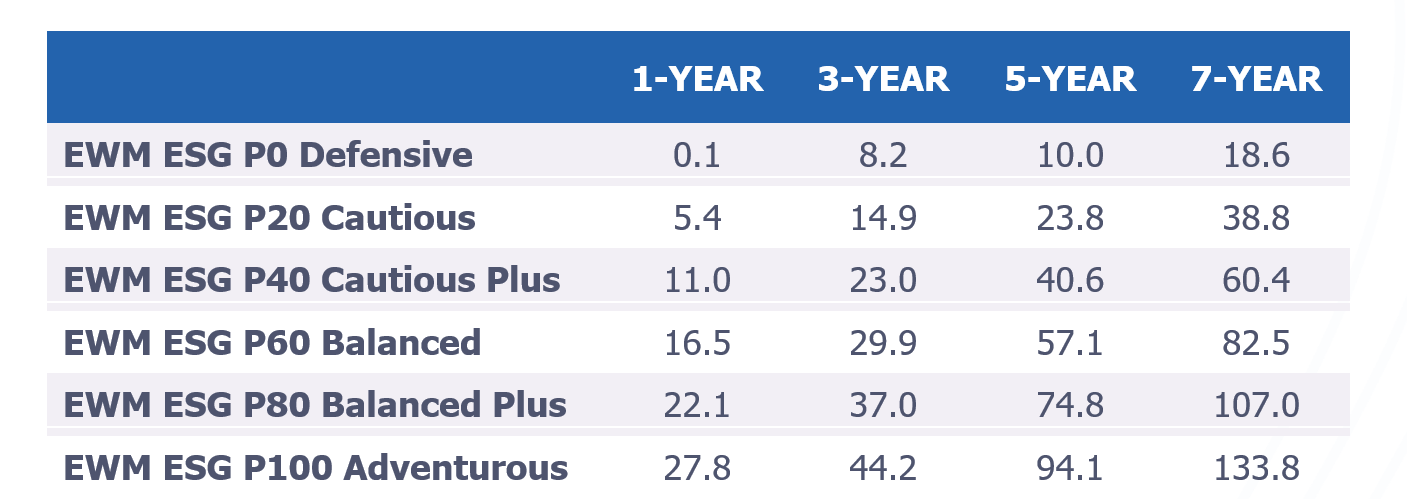

Portfolio returns continue to build on the momentum of last year. Returns over 1, 3, 5, and 7 years all continue to remain in positive territory across both portfolio ranges, with the exception of Expert Wealth Defensive, whose 1-year return was 0.2% owing to the trend in bond returns discussed above. The resurgence of value stocks which began in the latter part of 2020, continued, albeit at a decelerated rate over the second quarter. The impact of this resurgence is reflected in the superior returns over the 1-year period of the Expert Wealth models, which are more heavily tilted towards value. Over longer time periods the Expert Wealth ESG models continue to outperform.

Source: Betafolio (2021)

Source: Betafolio (2021)

Expert Wealth ESG Cumulative Gross Performance

Source: Betafolio (2021)

Source: Betafolio (2021)

Important Information

©2021 Expert Wealth Management. All rights reserved. Expert Wealth Management is a trading style of Expert Financial Solutions Ltd which is authorised and regulated by the Financial Conduct Authority. FCA No. 401295.

Past performance is no guarantee of future return. The value of investments and the income from them can go down as well as up. You may get back less than you invest. Transaction costs, taxes and inflation reduce investment returns.

The content of this bulletin is for education and information purposes only and should not be considered personal financial advice. Expert Wealth Management is not responsible for any action taken by clients as a result of this bulletin. Please contact us if you wish to discuss your portfolio.