Our fees

It is vital for us to be transparent about who we do our best work for, what we do and don’t do and what and how we charge for our service.

We work on a “no surprises” basis and will always confirm costs in advance once we know what work we’re doing for you.

Financial Planning

-

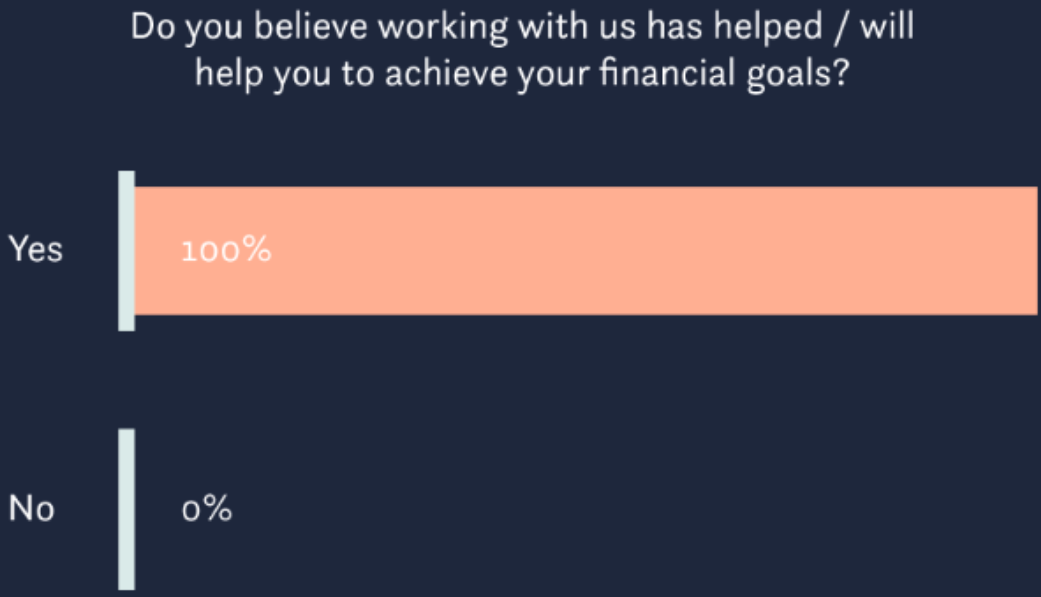

We provide an all-inclusive service with the sole objective of delivering great financial planning outcomes that help you meet your financial goals.

A great plan is meaningless without implementation, so we don’t do one-off transactions or planning-only work without implementation or portfolio management.

Together, we’ll craft and implement your financial plan to give you the greatest possibility of meeting your most cherished goals.

-

The best investors align their investments to the needs of a plan. Having crafted and implemented your plan, we’ll give you the best chance of a successful investment outcome by supporting the plan with a rational, highly diversified portfolio that is focused on risk management.

We charge at three stages of the process: Financial Planning, Implementation and Ongoing Service. Look below to understand what’s involved at every stage and the costs, then use our fee calculator to help you work out what you’re likely to pay.