Between April 2020 and April 2021, the coronavirus pandemic sent UK government borrowing to nearly £300 billion.

For the current tax year, the figure is expected to be lower – though it could still exceed £200 billion.

As the economy begins to recover and the chancellor looks for ways to claw back his pandemic overspend, he has another headache to contend with, in the form of the State Pension triple lock.

Here’s how an unexpected consequence of Rishi Sunak’s Coronavirus Job Retention (“furlough”) Scheme could lead to a State Pension windfall.

And why the £3 billion price tag might force the government to break a manifesto promise.

Understanding the State Pension triple lock

The coalition government introduced the State Pension triple lock in 2010. It is a manifesto promise of the current Conservative government to keep it in place until at least 2024.

Its purpose is to ensure that the value of the State Pension remains fair. The triple lock does this by committing to raise the State Pension each year by the highest of three separate measures:

- Inflation

- Average earnings growth

- 2.5%

This guarantees that your State Pension will increase by at least 2.5% each year, although it could be more if inflation or average earnings growth are high.

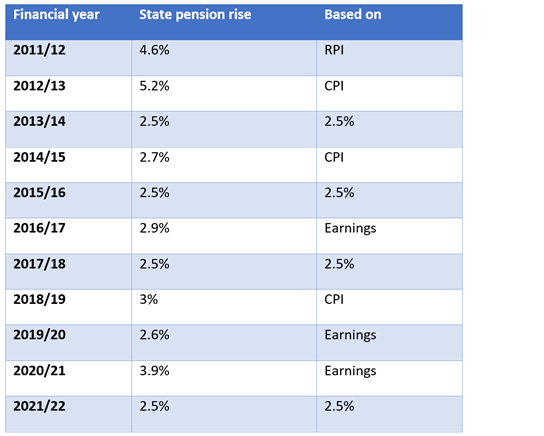

The largest increase in recent years was 3.9% in the 2020/21 tax year.

State Pension triple lock increases since 2011

Source: House of Commons research

While inflation is on the rise currently, it is average earnings growth that is threatening to cause problems for the chancellor.

The furlough scheme has led to higher than usual wage growth this year

Rishi Sunak launched his Coronavirus Job Retention Scheme in spring 2020. Introduced to prevent job losses while coronavirus lockdowns prevented employees from attending work, the government paid 80% of staff members wage, up to a monthly limit of £2,500 per employee.

Originally intended to cease after the initial lockdown, subsequent “stay at home” orders led to the scheme being extended, and then extended again. It is now due to wind up in September 2021.

The scheme has already cost the government billions, but a quirk of the triple lock means that it could be set to cost yet more.

Last year, with the government paying 80% of the salaries of those on furlough and inflation low, the State Pension rose by 2.5%. Now, however, as people return to work on full pay, average earnings growth is expected to reach nearly 8%.

The cost of raising the State Pension by this amount is calculated at around £3 billion higher than the government would have anticipated.

You could be about to receive a State Pension windfall

If the State Pension did rise by 8%, the full new State Pension amount for 2022/23 would be £193.97 a week, or £10,086.34 a year. The current amount is £179.60 a week (or £9,339.20 a year).

This potential £700-a-year rise under the current State Pension triple lock rules is great news for pensioners but it might not go ahead.

The coronavirus pandemic has been an unprecedented crisis and seen recording borrowing from the government, who can ill afford the extra £3 billion cost of the rise. They will still be reticent to break their election pledge, though, and to do so, Sunak will need the Prime Minister’s backing.

Following the news of the 8% rise in wage growth, the chancellor told BBC Breakfast News that concerns over the triple lock were “completely legitimate and fair concerns to raise. We want to make sure the decisions we make and the systems we have are fair, both for pensioners and for taxpayers.”

Many saw this as the first hint that the government might scrap, or at least temporarily break from the triple lock. A one-year suspension might be seen as “politically defensible”, according to the Guardian, due to “the unusual circumstances [surrounding the pandemic] and the need to fund other government priorities, such as the NHS and catchup funds for schools.”

Get in touch

The State Pension should form the backbone of your retirement planning and will continue to so do whatever the chancellor decides.

The plan you have in place is based on your long-term goals so if your goals haven’t changed, your plan doesn’t need to either.

If you are concerned about the level of State Pension you might receive we can help, so get in touch if you’d like to discuss any aspect of your long-term financial or retirement plans.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.