Back in September, the government announced a rise to National Insurance for employers, employees, and workers over the State Pension Age.

The announcement – which included a rise in Dividend Tax and the suspension of the State Pension triple lock – came despite a Conservative manifesto promise not to raise taxes.

The National Insurance rise of 1.25 percentage points has been dubbed a “Health and Social Care Levy”. It will look to address the economic impact of the coronavirus pandemic on the NHS and the widely publicised social care crisis.

Keep reading for everything you need to know about the new levy and what it means for you and your finances.

The new Health and Social Care Levy

The increase in National Insurance contributions (NICs) will come into effect from April 2022 for both employees and employers.

A year later, the rise in NICs will be replaced by the new Health and Social Care Levy and will appear as this on your payslip. From this point, it will also be payable by workers over State Pension Age, the first time NICs have been payable by this group.

It is estimated that more than a million pensioners will be hit by the rise. Contributions for those workers over State Pension Age (currently age 66) will start at a rate of 1.25% in April 2023. A working pensioner earning a salary of £60,000, and paying no NICs under the current system, will pay £630 a year from April 2023, on top of the Income Tax they pay.

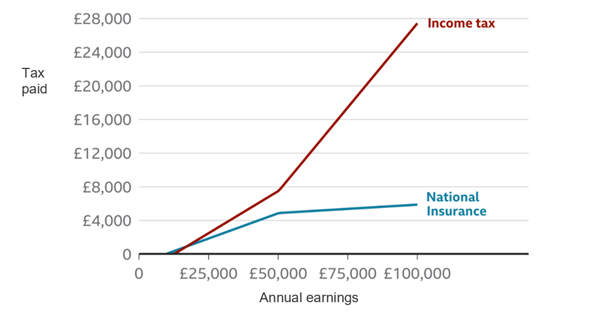

The Guardian estimates that those earning £50,000 will see their NICs rise from £4,852 to £5,357 each tax year, equivalent to a £505 tax increase. If you earn £100,000 a year, your annual contributions are likely to rise by around £1,130.

Increase in NICs for employees:

Source: BBC

As the UK economy continues its pandemic recovery, the government expects the new levy to raise an additional £12 billion a year over the next three years. Adult social care will benefit from £5.4 billion of investment, while £8.9 billion has been earmarked for a “health-based Covid response”.

More money will go directly to social care as the current NHS backlog begins to clear.

Adult social care reforms

The government has outlined several reforms to adult social care, to be funded by the new levy. These include:

- A cap on personal care costs of £86,000

- An increase to the upper capital limit, meaning that you should remain eligible for local authority support unless your capital exceeds £100,000. The previous threshold amount was £23,250.

- Increasing the lower capital limit so that you won’t contribute to your care costs if you have capital below £20,000. The previous limit was £14,250.

It is important to note that the £86,000 cap – intended to ensure that no one will have to pay more than this amount for care – currently applies to personal care costs only. So, this could include help with washing and eating but won’t cover living expenses, such as the cost of food, rent, or energy bills.

A large proportion of your care costs will need to come from your own pocket, long before the cap kicks in.

The new threshold amounts mean that those with assets below £20,000 will not have to pay anything towards their care. Those with assets above £100,000 will need to pay all fees until the value of their assets falls below this amount. If you have assets from £20,000 to £100,000 you will have to contribute on a sliding scale.

The new threshold amounts, and the £86,000 personal care cap, will come into force in October 2023.

What the change means for your long-term plans

Employees currently pay 12% NICs on earnings between £9,564 and £50,268, with anything above this amount liable to a rate of just 2%. This means that if your salary exceeds £50,268, NICs will account for a smaller proportion of your pay.

Source: BBC

It is important to remember that tax rates are subject to change but a long-term financial plan – aligned with your long-term goals – is designed to make your financial dreams a reality whatever regulations or the wider economy throws at it.

While we can help you mitigate the impact of any future tax rises and ensure your savings and investments are managed tax-efficiently, if your long term goals haven’t changed your plan won’t need to either.

Get in touch

If you are concerned about the impact of the Health and Social Care Levy on your long-term plans – or you’d like to discuss any aspect of your retirement savings or investments – get in touch and speak to one of our Chartered Financial Planners today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.