The government introduced a raft of tax changes in September 2021, intended to tackle the social care crisis and aid the UK’s economic recovery.

Along with the introduction of the Health and Social Care Levy and a freeze to the State Pension triple lock, the prime minister also announced a hike in Dividend Tax.

The change will see Dividend Tax rise by 1.25% from April 2022, a move that will mostly affect investors and business owners.

Keep reading to find out what the tax rise means for you and why business owners might need to rethink the level of dividends they receive.

Dividend Tax is increasing regardless of your tax band

You might receive dividends if you own shares in a company or own a business and pay yourself dividends to supplement a lower salary.

If you receive dividends currently, you will be aware that there is no tax to pay in some circumstances.

You won’t pay Dividend Tax on dividend income that remains within your Personal Allowance (£12,570 for the 2021/22 tax year). You also receive a Dividend Allowance each year (£2,000 in 2021/22).

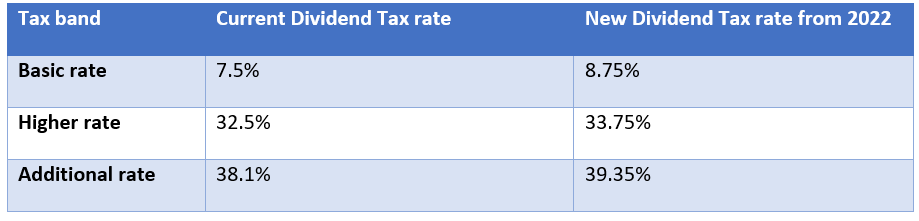

Any dividend that you receive over this allowance will be subject to tax at a new rate from April 2022, aligned with your tax band:

Someone taxed at the basic rate and receiving £3,000 in dividends, for example, would pay a Dividend Tax on £1,000. Under the proposed changes, their bill would rise from £75 to £87.50 in 2022.

As a higher-rate taxpayer taking £10,000 in dividend payments, you would pay 33.75% on £8,000 of dividends, a total of £2,700. This is £100 more than under the current system.

What the Dividend Tax rise means for you

The increase in Dividend Tax is expected to raise an additional £600 million from investors and the self-employed but could hit business owners the hardest.

If you run your own business, it is possible that you currently pay yourself a low salary and then use dividend payments to top-up your take-home pay. Not only is the tax rate lower (7.5% Dividend Tax for the basic rate under the old system, compared to 20% Income Tax), but your National Insurance burden is lessened too.

The increases announced last month – to Dividend Tax and employer National Insurance contributions (NICs), as well as to Corporation Tax – might mean it is time to revisit your approach.

The changes provide a timely reminder that tax rules can change, and the chancellor’s upcoming Autumn Budget could bring yet more surprises.

Protecting your money

Recent changes highlight the importance of protecting your wealth. You might do this by making the most of tax-efficient products such as pensions and ISAs.

You do not pay tax on dividends from shares in an ISA and gains you make on a Stocks and Shares ISA are free of both Income Tax and Capital Gains Tax (CGT).

Pension tax relief makes pensions a particularly tax-efficient way of providing yourself with an income in later life, but the highest rates of relief could be in danger when the chancellor, Rishi Sunak, unleashes his Autumn Budget at the end of the month.

The most important thing you can do is to acknowledge that tax rule changes don’t necessarily need to impact your long-term planning.

Long-term investment, aligned with long-term goals, is the best way to make your retirement dreams a reality. If you do need to make changes, we can help you realign your investments or discuss the salary you take from your business, helping you to mitigate against the impact of recent and future changes.

Get in touch

If you are concerned about recent tax rises – to National Insurance, Dividend Tax and Corporation Tax, or the suspension of the State Pension triple lock – get in touch.

We can help to allay your fears or realign your investments and tax strategies to help you mitigate the worst impacts of the changes. Get in touch and speak to one of our Chartered Financial Planners today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.