Recent figures published in the Independent suggest that the traditional role of the Bank of Mum and Dad could be a thing of the past. While it is usually associated with helping children onto the property ladder, this might be only half the story.

The millennial generation is widely believed to be the first generation since the 1800s to be worse off than their parents. As stagnant wage growth combines with rising house prices, the coronavirus pandemic, and the current cost-of-living crisis, the Bank of Mum and Dad is providing many different types of financial support.

Here’s how you might be helping your children, and how starting to save earlier through a Junior ISA could ensure the support you give won’t detrimentally affect your standard of living.

Help with a house deposit is the fourth most likely way for the Bank of Mum and Dad to offer financial support

Helping your children to get onto the property ladder might be the traditional reason for parents to open the Bank of Mum and Dad, but, according to the latest research, it is no longer the most popular.

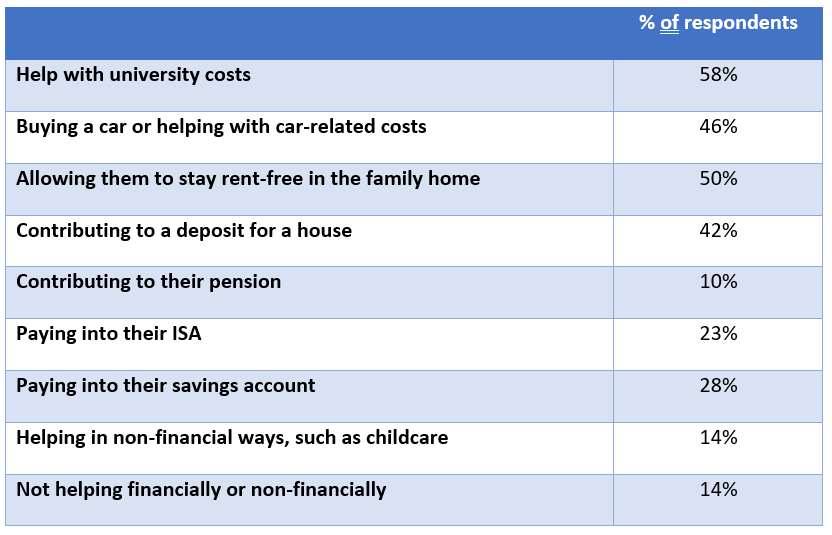

Helping with university costs (58%), buying a car or helping with its running costs (46%), and rent-free accommodation in the family home (50%) are all more likely ways to offer financial support.

Payments into pensions, ISAs, and other savings products, as well as non-financial help with childcare, for example, also made the list.

Only 14% of respondents claimed that they had offered no help of any kind, whether financially or non-financially.

If you’re intending to support your children financially in the future, it might be worth taking the time now to consider the type of help they need. This can help you focus on the right ways to provide that help, without detrimentally affecting your own finances.

A Junior ISA could help you save, whatever support you intend to give your grown-up child

The most popular reason to open the Bank of Mum and Dad is to help with the cost of higher education. You can start to save towards this the moment your child is born, through savings and investment accounts like a Junior ISA (JISA).

A JISA can be opened by a parent or guardian on behalf of any UK resident under the age of 16. Once set up, grandparents, extended family, and friends can all contribute.

A JISA is tax-efficient

You can contribute up to £9,000 into a Cash or a Stocks and Shares JISA in the 2021/22 tax year. In the current low-interest, high-inflation economy the additional risk attached to a Stocks and Shares JISA might be a good option, although both types are tax-efficient.

Interest earned in a Cash JISA is tax-free and gains made in a Stocks and Shares JISA are also free of Capital Gains and Income Tax.

HMRC gifting rules could allow for tax-free contributions

HMRC allows you to make some gifts each year tax-free. One such exemption exists for gifts made out of normal income.

You might consider using this exemption to make regular payments into your child’s JISA. To be Inheritance Tax-exempt, you must be able to prove that the payments are regular, that they are made from income, and that they don’t detrimentally affect your standard of living.

If the fund is to be used to buy a first car, a JISA could be the perfect option. If the money isn’t withdrawn immediately at age 18, the JISA converts to an adult ISA and the annual subscription limit increases to £20,000 (2021/22).

Consider a bare trust if you want to keep control over how funds are used

Your child gains control of their JISA account from the age of 18 so, if you’ll want some control over how the money is used after the age of 18, you might consider a trust. These can be complex, though, so be sure to speak to us before deciding.

Get in touch

With decades of experience, our Chartered Financial Planners have the expertise to help you plan ahead for the financial support you’ll want to provide to your loved ones. If you have any questions, please get in touch and speak to us today.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.