The first quarterly report of 2021 is introduced by Robin Powell

Index funds DO care about ESG

When powerful vested interests feel threatened by inconvenient evidence they often respond in the same way. Instead of challenging it head-on with counter-evidence of their own, they seek to undermine it by spreading and perpetuating myths.

The tobacco industry spent billions obscuring the facts of the health effects of smoking over several decades. The fossil fuel industry responded in the same way to growing evidence of climate change.

Existential Crisis

Today, active fund management is facing a similarly existential crisis as a result of the rise of passive investing, which helps to explain the steady stream of myths we read about index funds. We are told, for example, that indexing makes markets unstable, that it threatens market efficiency and even capitalism itself—none of which is true.

Another myth doing the rounds in recent years is the notion put forward in an open -editorial in the Wall Street Journal in June 2017, that passive investors don’t care about corporate governance. Indexers, the argument goes, are only interested in financial returns, and managers of index funds have little or no incentive to hold company boards to account on issues like excessive corporate pay, staff welfare, social justice and the environment.

But is it true? Once again, there’s another side of the story which we rarely hear.

Stronger Incentive

Think about it: index funds should, in theory, have a stronger incentive to monitor the firms in their portfolios than active managers, who can simply sell out of their positions if they disagree with management. Index funds, by definition, are in it for the long term. If the company’s stock is on the underlying index, they have no choice but to engage with the board. It is, moreover, in their interests to do so in order to compete with active funds that have discretion over their holdings.

But what about in practice? Do index funds challenge company boards on ESG issues? There have been several academic studies on this subject over the years, and most show that managers of passive funds are just as likely as their active counterparts to hold boards to account —if not more so.

Academic Studies

In a 2016 study called Passive Investors, Not Passive Owners, Ian Appel, Todd Gormley and Donald Keim found that index ownership at a firm is associated with more independent directors, the removal of takeover defences and more equal voting rights.

The same authors revisited the subject with another paper, published in 2018. In it they established a link between increased index ownership and greater use of proxy fights by activists, as well as a higher likelihood that an activist obtains representation on the board of the target firm.

In March 2020, Joseph Farizo from the University of Richmond in Virginia published an in-depth study on the voting records of both passive and active funds. Farizo concluded that the evidence “dispels the concern that index funds, at least in the aggregate, completely disregard voting responsibilities by either always siding with management”.

Passive Funds Have More Clout

In October 2020, the Faculty of Law at the University of Oxford published a paper by Adrian Aycum Corum from Cornell University and Andrey and Nadya Malenko from the University of Michigan called Corporate Governance in the Presence of Active and Passive Delegated Investment. Although the findings were less clear-cut than those of the other papers mentioned here, they nevertheless dispelled the idea that passive funds are bad for governance simply because their fees are lower, leading to smaller budgets for governance oversight.

The authors wrote:

“While passive fund growth indeed decreases fund fees, it may nevertheless be beneficial for governance. The reason is that fund fees do not decrease in isolation: lower fees are accompanied by higher AUM, allowing funds to take larger stakes in their portfolio companies. These larger stakes, in turn, give funds stronger incentives to engage.”

In other words, the growth of indexing has given passive managers more clout when it comes to ESG, and we are pleased to see providers such as Vanguard, beefing improvingup their ESG resources in Europe and the US.

Conclusion

In summary, the claim that index funds present a danger to governance because they adopt a hands-off approach, allowing management to act as it wants to, is another myth created by the fund industry. It wants and needs investors to believe it, but it simply isn’t true.

Index funds care just as much about ESG as active funds do, and arguably more so.

Robin Powell is Editor of The Evidence-Based Investor and has been a guest speaker for EWM at our virtual client event on 4th November 2020.

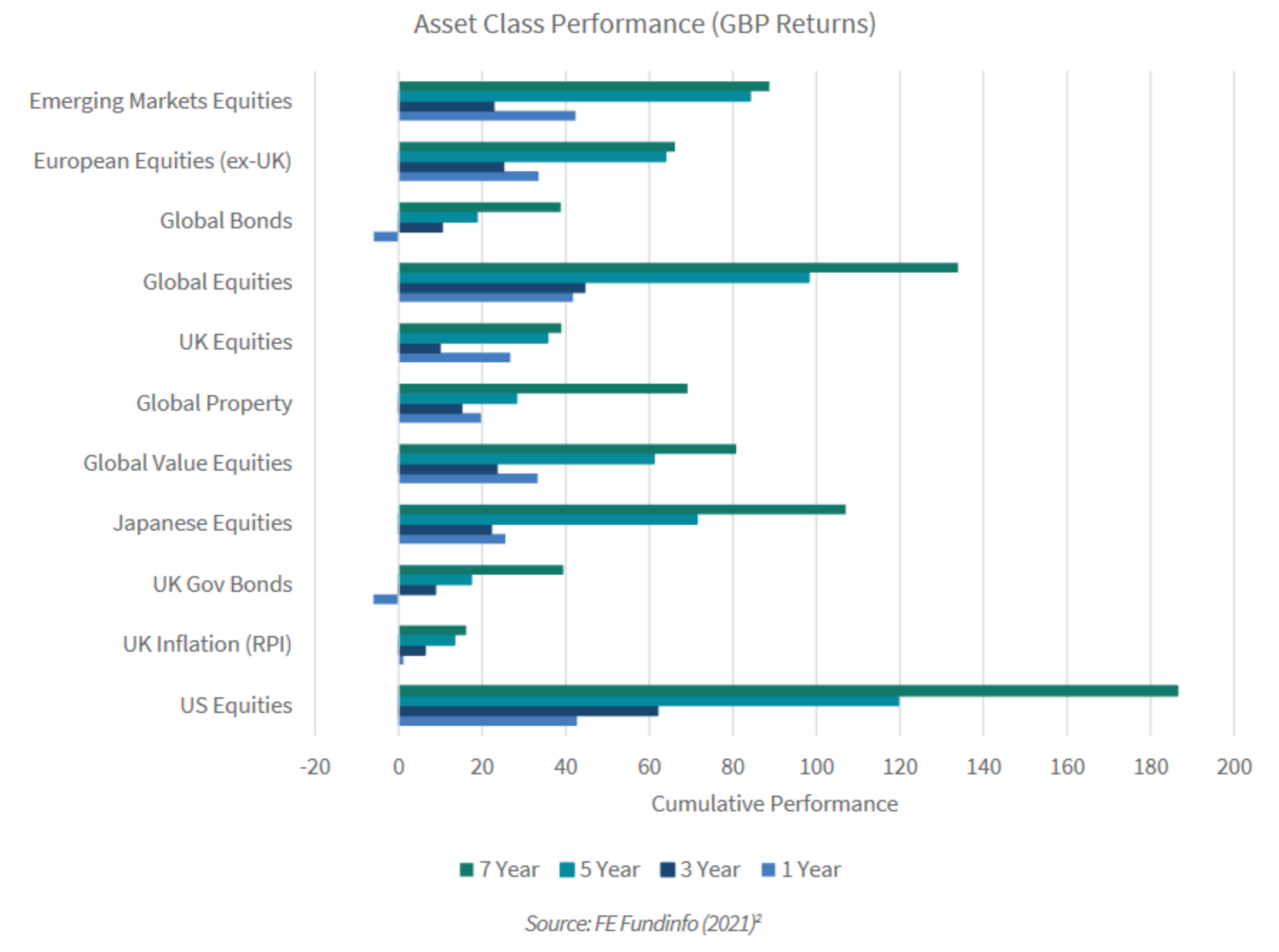

Asset Class Return

After numerous lockdowns and false starts in 2020, the widespread rollout of the COVID-19 vaccine has given real hope that economies will soon be able to fully re-open. The International Monetary Fund (IMF) revised its projections of world economic growth in 2021 up to 6%, an increase of 0.5% from its predictions in January. This is the fastest rate of global economic growth since 1980 and is in stark contrast to the reduction in global output of 3.3% in 2020, the worst since the Great Depression (IMF 2021).

As in the previous quarter, the change of leadership in Washington was a dominant theme. Once inaugurated, President Biden wasted no time in announcing the American Rescue Plan, a $1.9 trillion stimulus package. This was signed into law in March. Shortly afterwards, the President announced his intention to spend an additional $2trillion to rejuvenate the USA’s infrastructure via the American Jobs Plan. US equity markets, as to be expected, reacted favourably and the S&P 500 increased by 7.4% over the quarter. With this additional support and increasingly positive outlook for the US economy, the IMF amended its predictions of US economic growth from 5.1% to 6.4% for 2021 (IMF 2021).

China, together with the USA are seen to be driving the global recovery. China was the first country to encounter the virus, first to shut down and the first to re-open. The Chinese economy is expected to grow by 8.4% (IMF 2021) this year despite the continuing trade war with the USA. For another quarter, China again failed to fulfil its commitments to increase imports of US goods, as outlined in the “Phase One” agreement signed back in January 2020. There were hopes that changes in The WhiteHouse would result in a more cordial relationship between the two nations. However, the first call between President Biden and his Chinese counterpart Xi Jinping in February were reported to be tense. Later in March, angry exchanges between the two nations during high level talks played out in front of the world’s media. As the quarter drew to a close the US reaffirmed its position that it had no immediate plans to lift tariffs introduced, but did express a willingness to engage in further trade talks.

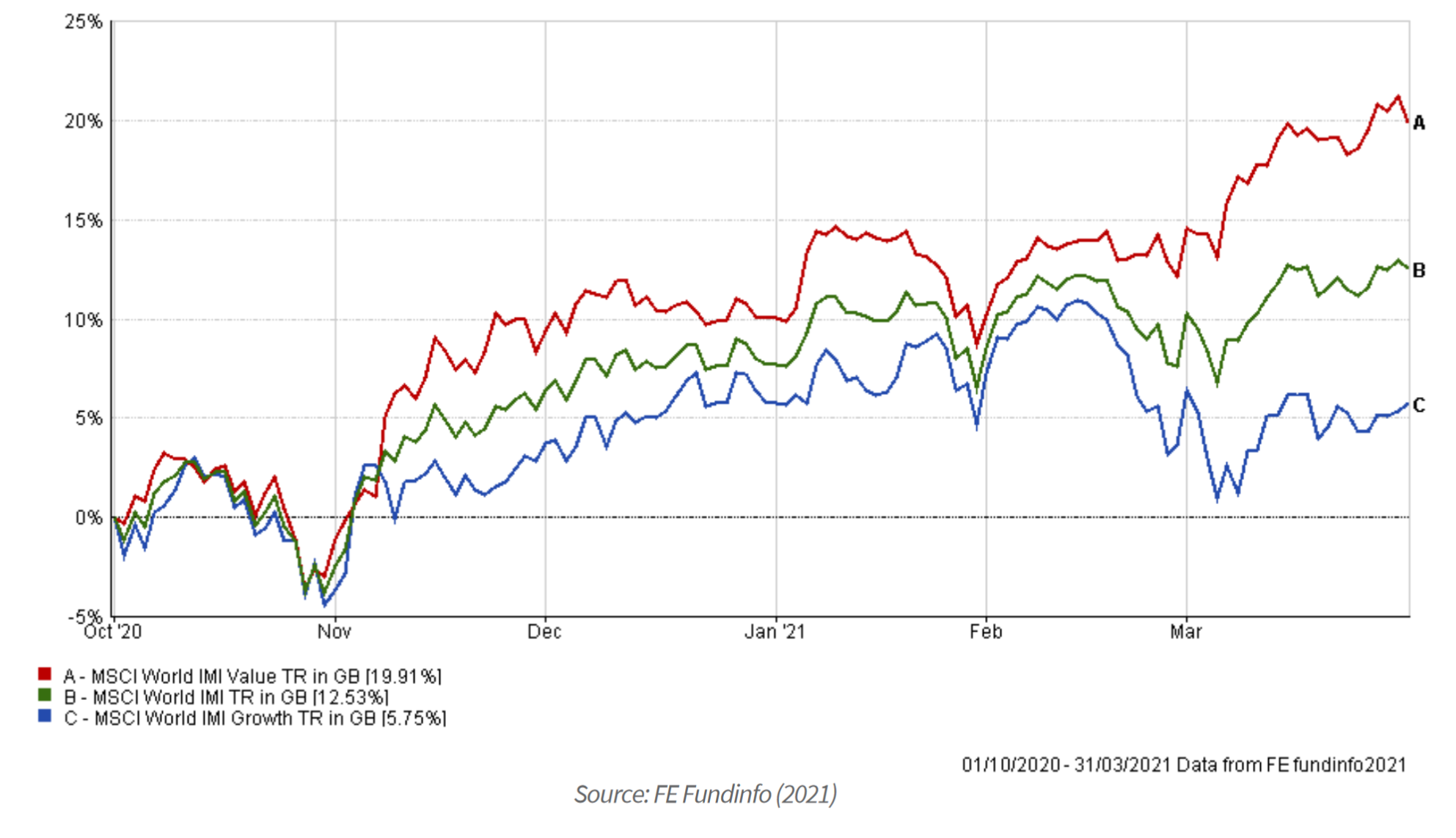

The first quarter of 2021 saw a continued resurgence in value stocks, giving further hope to long embattled value investors that the initial upswing in value stocks observed in the last quarter of 2020 was here to stay. Value investing is a strategy whereby investors seek to identify stocks that are currently undervalued by the market. The intention is to buy these “cheap”, value stocks and profit from their eventual increase in price. The opposite strategy is that of growth investing, whereby investors attempt to identify firms whose revenue and earnings will grow faster than the market average.

During 2020, with the assistance of governments and central banks, equity markets rebounded quickly. However, the disparity between the performance of value and growth stocks initially only increased. This was because of the disproportionate impact that lockdowns had on value stocks, which tend to be more cyclical in nature, for example energy, retail, and transport. Growth stocks were more resilient, and some for example, technology stocks, even benefited from the restrictions.

In the last quarter of 2020, investors’ expectations began to change. With the approval of a number of COVID-19 vaccines together with President-elect Biden’s plan to spend trillions of dollars to revive the US economy once in office, the prospect of an economic recovery looked promising. Cyclical stocks looked to benefit more from the developments and hence value stocks began to rise. As 2021 began, the vaccine rollout globally gathered pace and further US stimulus plans were announced, sustaining the value rally.

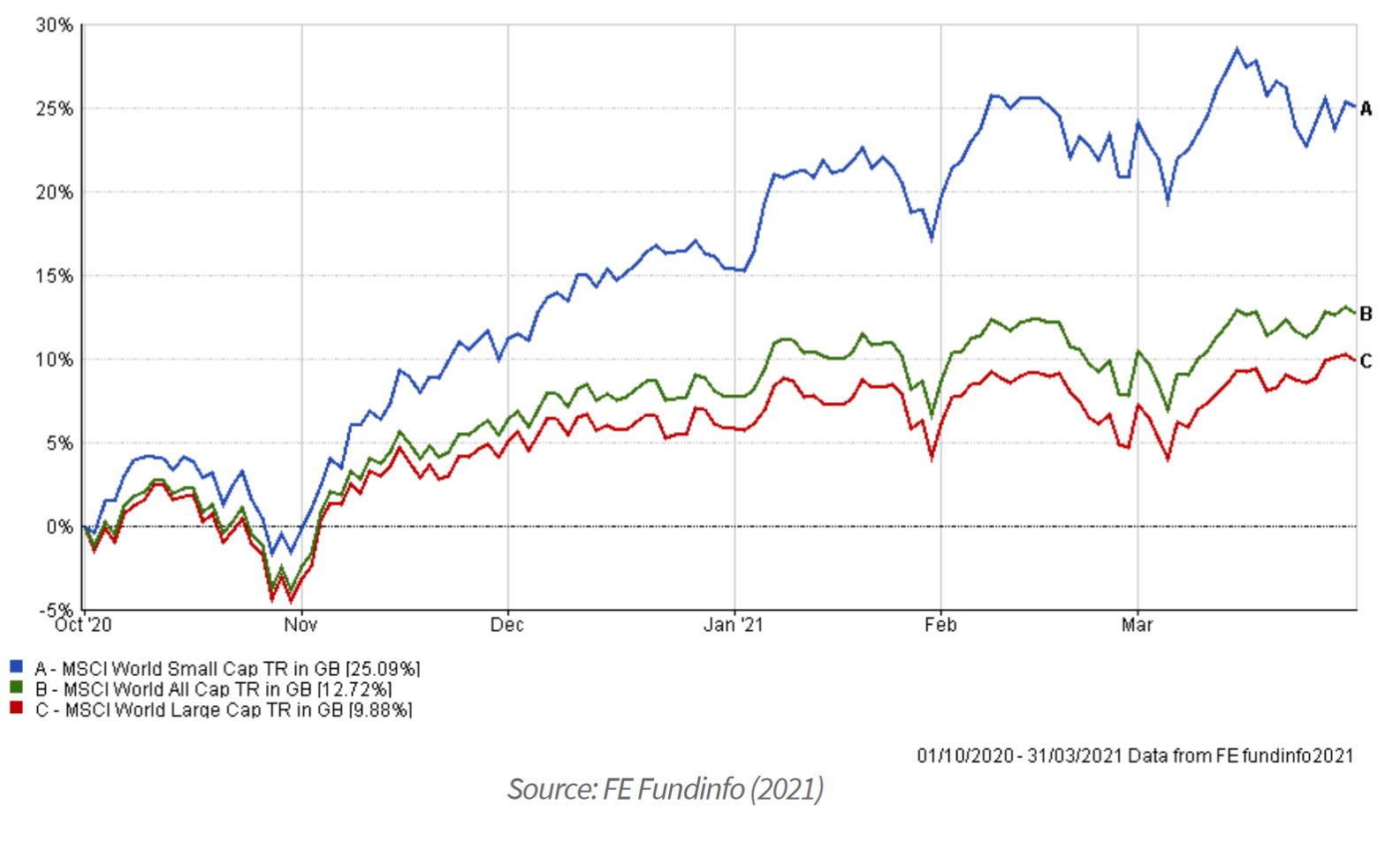

The reversal of fortunes for value stocks were not the only sector of the market to see a rotation in fortune. Size investors, those looking to invest in small-cap companies, which had also been hit hard by the pandemic, also continued their upwards momentum, which began in the last quarter.

Akin to value stocks, things started to shift in the last quarter of 2020. Small stocks returns are closely linked to the performance of the overall economy. With signs that economic recovery could be fast approaching in the last quarter of 2020, suddenly smaller firms, whose stocks were cheaper, became an attractive proposition for their potential to deliver higher returns in 2021.

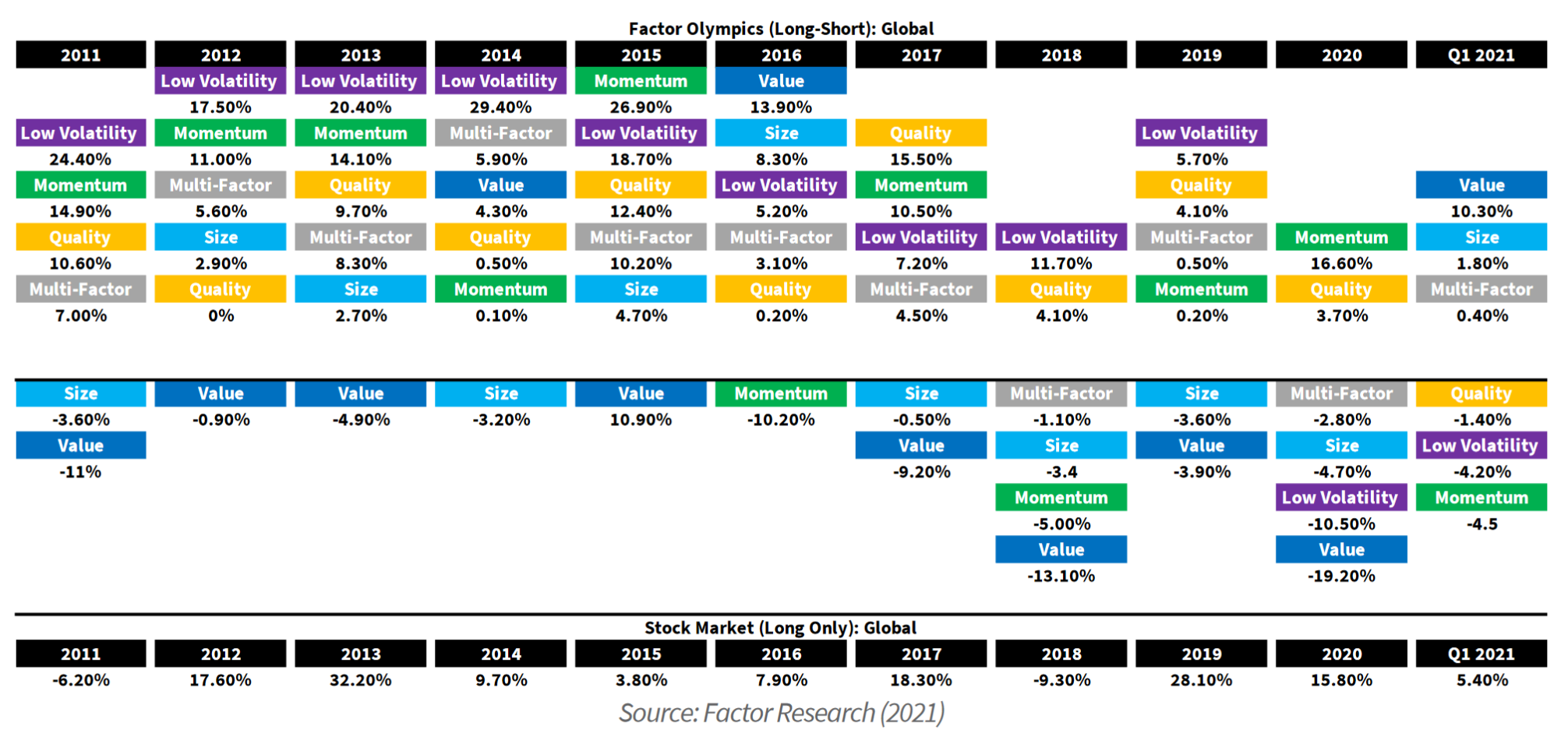

A review of the performance of five well known factors strategies over the last ten years reveals the extent of the rotation to size and value in the first quarter of 2021; the losers of previous years, showing the cyclical nature of the value factor. Contrastingly, momentum, quality and low volatility have generated negative returns.

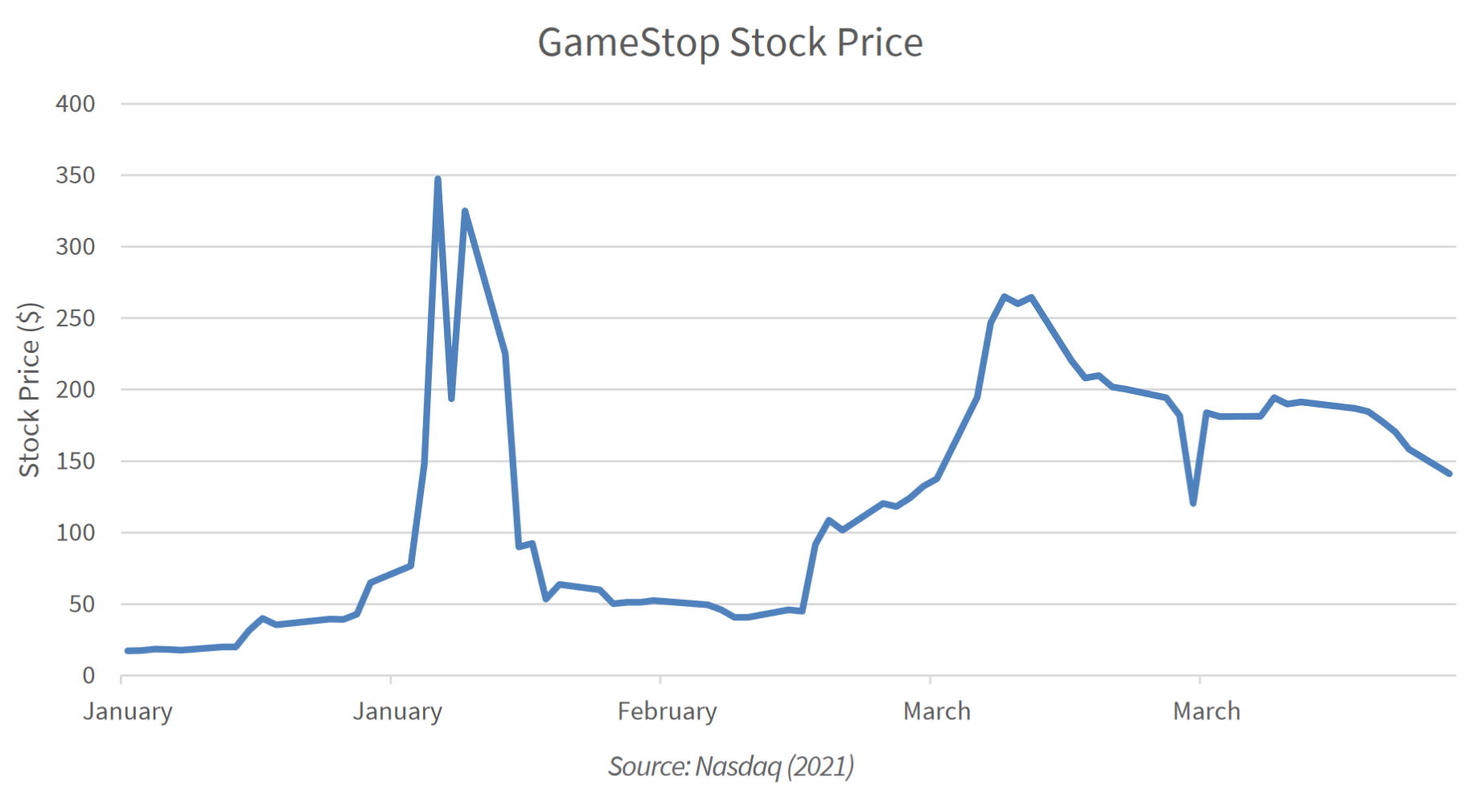

It was not only the US government’s stimulus spending and global inoculation programmes that were impacting equity prices in the first quarter. Early 2021 saw an unusual David-and-Goliath battle over GameStop stock. The most popular explanation of events has been of that of “the populists (a phrase that doesn’t really mean much anymore, beyond just “a collection of guys who are mad”) versus the Institutions” (WashingtonPost 2021) essentially, a young group of stock picking enthusiasts, wanting to test the financial system to make sense of whether it was all smoke and mirrors, set up by large financial intuitions for self-gain, or an efficient capital market engine.

Large investment banks, believing the firm’s stock was all but finished had taken “short” positions, hoping to profit from a fall in its price and eventual demise, common practice in modern day active management, known as short selling. Unfortunately for them, a social media group had formed, unhappy at the “shorting”, believing that the stock had real value in its fundamental business offering. They recruited a mass following of likeminded buyers and using trading apps, drove the price of the stock upwards, causing it to increase from $17.25 to $347.51 during January, an increase in price of 1914.5%. The motivation of the majority of these investors then progressed into punishing hedge funds and testing the financial system, as opposed to a genuine belief that the firm was undervalued. However, some investors undoubtedly were able to take advantage of the rapid increase in price and make a quick profit.

The saga continued over the quarter, the stock’s price remained volatile and trading was suspended on various platforms resulting in claims of foul play by investors who saw this as illegal intervention. The US government and regulatory agencies took notice and launched a number on investigations. Where will it end for GameStop? No one really knows, but fundamentally, the company appears hugely overvalued, with social media led investors refusing to sell, claiming it is now not about the profits.

We all like an underdog story but investing is not about trying to turn a short-term profit; that is pure speculation or as some may say, gambling. If you fancy a gamble, then sure, instead of putting your money on “Number 4” at Cheltenham, buy GameStop, but be prepared to lose your entire bet. Unfortunately, despite what you see in the movies, investing correctly is a slow and disciplined process best served by investing in low cost, diversified index funds.

Portfolio Performance (3)

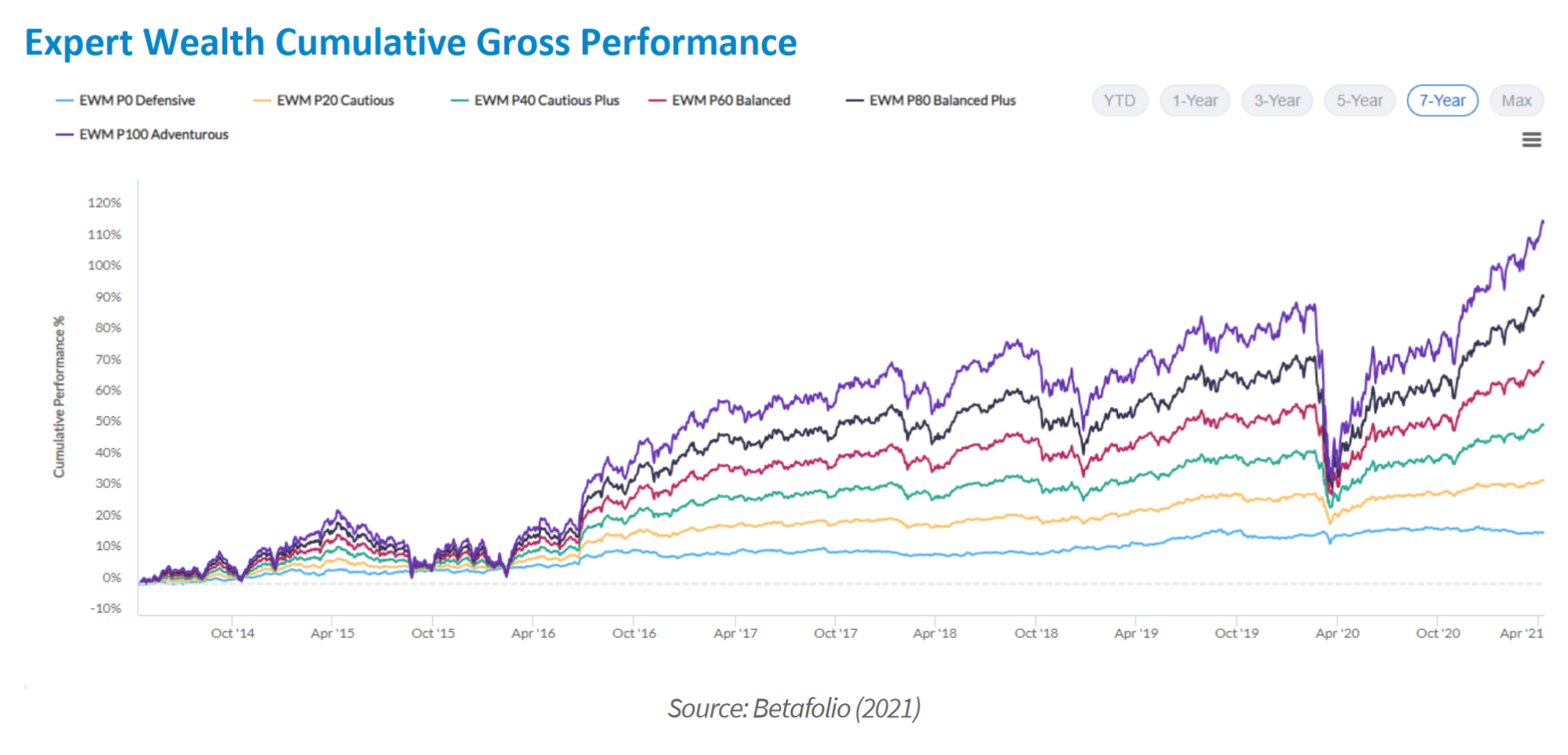

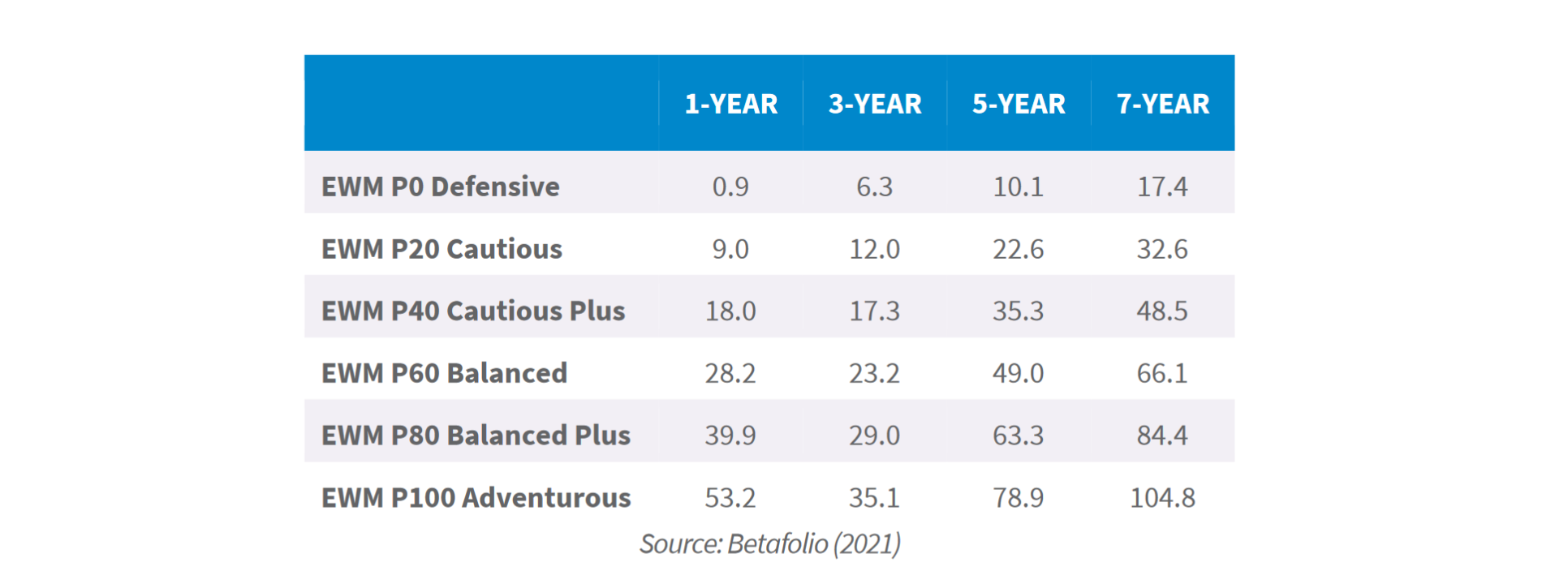

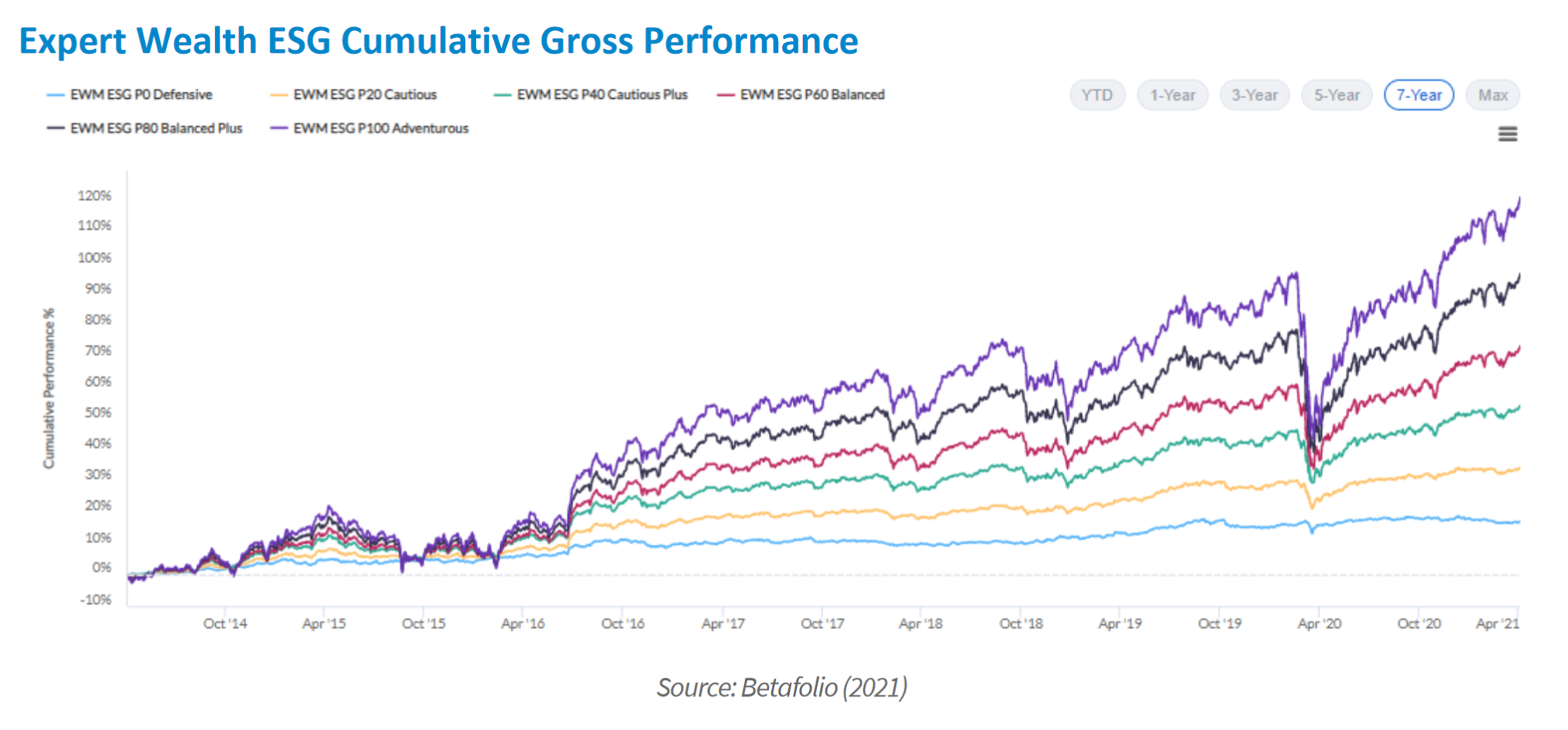

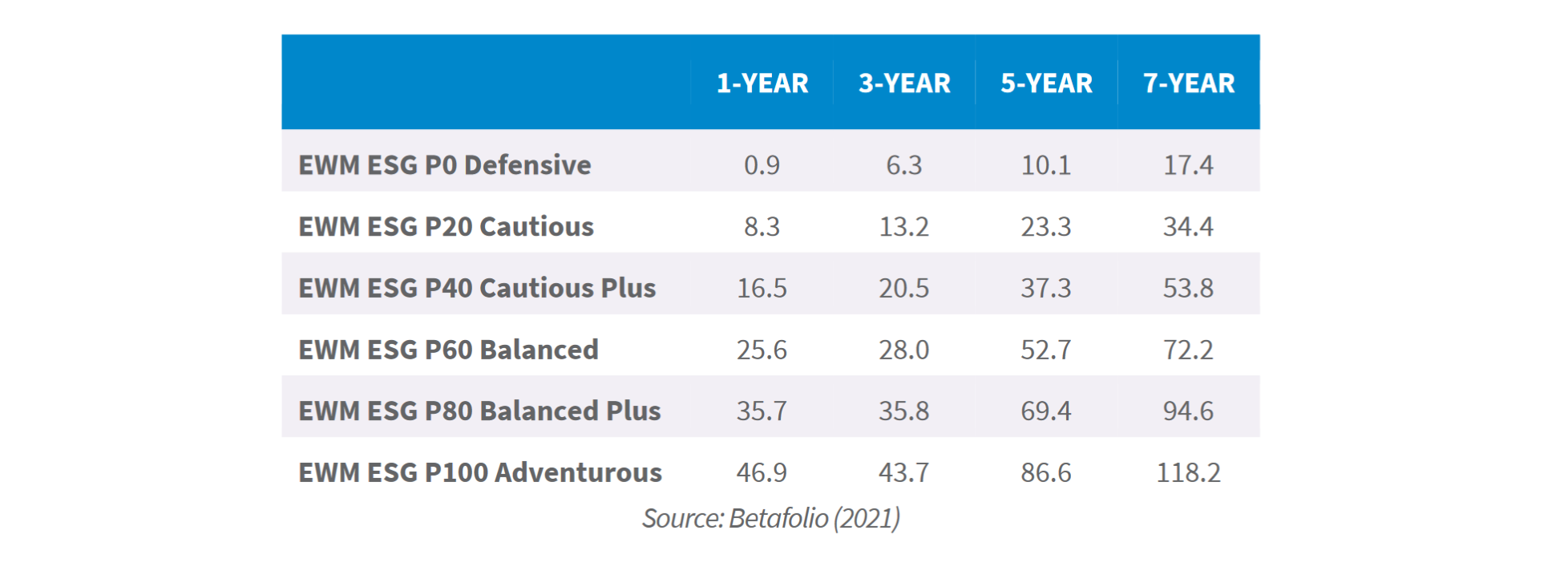

Portfolio returns continue to build on the late momentum of last year. Returns over 1, 3, 5, and 7 years continue to remain in positive territory across all the Expert Wealth models. Historically, the ESG range has outperformed the standard range due to the latter’s exposure to the value premium which has underperformed for a prolonged period of time. In contrast, due to the resurgence of the value premium over the last two quarters, we have seen the performance of the standard range outperform the ESG range. This is reflected in the 1-year rolling returns. Returns of the standard models, over the 1-year period are in excess of the returns of the equivalent ESG models. Over longer time periods, the ESG models continue to outperform.

Closing Words

This time last year the world was reeling from the realisation that the virus that had taken hold of our day to day normality and posed a serious global health threat. Governments responded by introducing strict lockdowns and the ensuing panic caused the fasted 30% drawdown of global equities in history.

The team here at Expert Wealth will freely admit to being flabbergasted by the market’s reaction. However, our data told us that large market shocks, although rare, had occurred for known reasons in the past and that markets would recover. Indeed, we saw the subsequent fastest and largest advance in equities markets in history during the second quarter of 2020. A year on and equity markets are above their pre-shock levels. This recovery has been made possible by the tenacity of some very clever scientists to whom we all owe a debt; developing vaccines in months as opposed to years. In the UK at least, we appear to have the virus on the back foot, and it looks increasingly likely that life may soon return to some kind of normality. However, with France and Germany recently announcing new lockdowns as they struggle to curb a third wave, it reminds us that the pandemic is far from over. Foremost, we wish everyone a safe return to normality and hope the performance of your portfolio during the last year serves to reassure you of the robustness of its construction.

Note 2 – Asset Class Diagram Sources: Global Bonds: Bloomberg Barclays Global Aggregate, UK Gov Bond: Bloomberg Barclays Global Aggregate UK Government Float Adjusted, UK Equities: FTSE All Share, Global Property: FTSE EPRA Nareit Global, Emerging Markets Equity: MSCI Emerging Markets, EU Equities (ex-UK): MSCI Europe ex UK, Japanese Equities: MSCI Japan, US Equities: MSCI USA, Global Value Equities: MSCI World Small Value, Global Equities: FTSE Global All Cap, UK Inflation (RPI): UK Retail Price Index

Note 3 – All data is up to last price –5thApril 2021. Past performance is no guarantee of future return. Data sourced from Morningstar API. Careful consideration has been taken to ensure that the information is correct but it neither warrants, represents nor guarantees the contents of the information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Percentages may not total 100 due to rounding. Performance Periods: 1Year: 05/04/2020-05/04/2021; -3 Year: 05/04/2018-05/04/2021, 5 Year: 05/04/2016-05/04/2021, 7 Year: 05/04/2014-05/04/2021. Additional performance periods may be accessed with the help of your adviser via the Betafolio Control Centre: https://app.betafolio.co.uk/

Expert Wealth Management is a trading style of Expert Financial Solutions Ltd which is authorised and regulated by FCA. Our FRN is 401295. Past performance is no guarantee of future return. The value of investments and the income from them can go down as well as up. You may get back less than you invested. Transaction costs, taxes and inflation reduce investment returns. Nothing in this bulletin constitutes personal, regulated, financial advice. It is written and provided for educational and reference purposes only.