In his 2023 Autumn Statement, the chancellor, Jeremy Hunt, unveiled several measures that could have considerable implications for your wealth in 2024.

Not only that, but legislative changes could affect the economy as a whole. Indeed, with the Autumn Statement now behind us, the Office for Budget Responsibility (OBR) has updated its forecasts for 2024 and beyond.

Continue reading to discover some of the main changes announced in the Autumn Statement, and what they might mean for your finances over the next 12 months.

The pension Lifetime Allowance will be abolished next year

While there were no new announcements on pension allowances during the Autumn Statement, we do know that the previously announced abolition of the Lifetime Allowance (LTA) is going ahead.

The LTA is the total amount you can withdraw from the pension you hold without facing an additional tax charge. This amount stood at £1,073,100 while the charge on those funds exceeding that amount was 55%.

From April 2023, the government suspended the LTA tax charge, with plans to scrap it entirely later. This move has now been confirmed, meaning that from 6 April 2024, you can accrue a potentially unlimited amount of money in your pension.

This could significantly alter your retirement plans. Indeed, you could continue to contribute to your pension, even if you’re already approaching the previous LTA figure, ultimately giving your retirement income a considerable boost by the time you stop working.

It’s important to remember that the maximum tax-free cash amount you can take from your pension is still frozen at £268,275 (25% of the LTA threshold at last count).

Note, too, that a future Labour government might look to reinstate the LTA.

The State Pension “triple lock” will be honoured in 2024

The chancellor also confirmed in the Autumn Statement that the government will honour the State Pension “triple lock”.

This ensures that the State Pension increases in line with the cost of living each year by the higher of:

- Inflation, as measured by the Consumer Prices Index (CPI) in September of the previous year

- Average increase in wages across the UK from May to July of the previous year

- 5%.

Due to wage growth of 8.5%, the new full State Pension will rise from £203.85 a week to £221.20, or an extra £905 a year.

Meanwhile, the old State Pension will rise from £156.20 each week to £169.50, providing an additional £693 a year.

While the State Pension may not be sufficient to maintain your desired standard of living on its own, the regular, inflation-proofed income could form the bedrock of your plans.

National Insurance has been cut for employees and self-employed workers

The chancellor also announced that National Insurance (NI) will be cut, which he stated was the “biggest tax cut on work since the 1980s”.

After 6 January 2024, the main rate of National Insurance contributions (NICs) paid by employees will drop from 12% to 10%. The Guardian confirms that this could save the average employee earning £35,400 a year more than £450 annually.

Moreover, Class 2 NICs – which are mandatory for self-employed workers earning more than £12,570 a year – will also be abolished from April 2024. FTAdviser estimates that this will save the average self-employed person £192, and they will retain their access to contributory benefits, such as the State Pension.

Similarly, in the 2024/25 tax year, Class 4 NICs paid by self-employed workers on earnings between £12,570 and £50,270 will fall from 9% to 8%.

Combined, these two changes will reportedly mean that the average self-employed person earning £28,200 could save £350 a year.

The chancellor, though, made no announcements on Income Tax, so thresholds are still frozen until 2028.

This freeze, effectively a stealth tax, could drag you into a higher Income Tax band as your wages rise over the next four years.

The Office for Budget Responsibility updated its 2024 forecast following the Autumn Statement

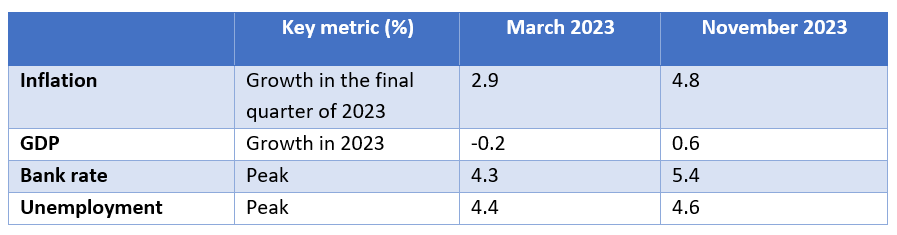

In March 2023, the OBR made several predictions about the state of the UK economy. Following the Autumn Statement, it altered several of these forecasts.

Source: Office for Budget Responsibility

The OBR expects the abolition of the LTA (paired with the Annual Allowance increase, from £40,000 to £60,000) to cost the government as much as £1.6 billion.

As for the NI cuts, it’s estimated that they could increase employment by 28,000. Despite this, the table above shows that the OBR still predicts unemployment will rise.

The OBR forecasts show that, between 2022/23 and 2028/29, threshold freezes could mean that:

- Nearly 4 million extra individuals will be expected to pay Income Tax

- 3 million more will move to the higher rate

- 400,000 more will move onto the additional rate.

The OBR estimates that this fiscal drag could raise more than £44 billion for the government in 2028/29.

Consider seeking financial advice now

Keeping on top of changes to financial legislation can be difficult, so be sure to check in it with us if you’re worried about the implications of any of these changes for your finances.

Please get in touch and speak to our Chartered Financial Planners today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.