When the chancellor confirmed that large-scale tax reform would be left out of his spring Budget – and would instead be announced separately – expectations for “tax day” reforms were high.

In reality, and to the relief of many pension savers and investors, anticipated reforms to pension tax relief and Capital Gains Tax (CGT), among others, were not announced.

One area that did see positive change, however, was Inheritance Tax (IHT). Specifically, changes were made to IHT paperwork associated with managing an estate following a death. This was in line with one of the recommendations made by the Office of Tax Simplification (OTS) in its review into IHT.

This is good news for many, with the administration of a deceased’s estate causing significant stress and anxiety for the bereaved, at an already challenging time.

So, why was change needed? What did the chancellor announce and what do the changes mean for those dealing with a loved one’s estate?

Simplification was required to protect the wellbeing of the bereaved

A review by the Office of Tax Simplification (OTS) into IHT was commissioned back in January 2018. In its first report, in November of that year, the OTS provided eight recommendations, including amendments to form-filling processes.

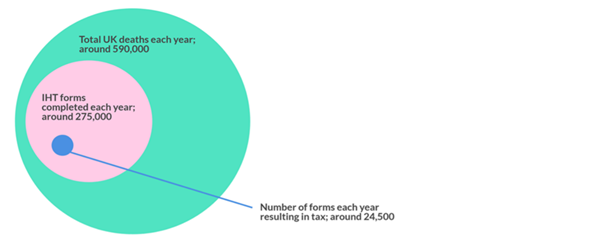

It noted that forms were required to be completed for almost half of UK deaths each year, despite only a small percentage of those resulting in tax being payable.

Source: Office of Tax Simplification (OTS)

An OTS survey looked to understand the experience of estate administration for the bereaved.

It found that of the total responders who did not have an adviser, 38% spent 50 hours or more on estate administration. Only a quarter of all those surveyed recalled receiving an acknowledgement to say their paperwork had been received, and 61% did not know how long it would take HMRC to respond.

This seems to tally with a recent Exizent report, published by the probate specialists in their Bereavement Index. The report stated that 95% of the bereaved found the process of dealing with paperwork stressful, while 20% became “extremely stressed”.

Most significantly, it found that dealing with a deceased’s finances causes mental health problems for 40% of the bereaved.

“Tax day” changes cut the red tape for 90% of non-taxpaying estates

The chancellor used his “tax day” announcement to confirm that “reporting regulations will be simplified” and that “90% of non-taxpaying estates” will no longer have to complete IHT forms for deaths when probate or confirmation is needed.

Regulations are being updated so that the changes will take effect from 1 January 2022.

The amount of stress caused by the administration process had been worsened by the coronavirus pandemic. In acknowledgement of this, some changes had been made to ease the strain for both HMRC and the bereaved, and one such “temporary provision” has now been made permanent.

The IHT return – submitted to HMRC by the executors – could be accepted electronically, or with a printed signature, during the pandemic. This will now be allowed going forward and will shortly be written into regulation.

The importance of estate planning

Every part of your estate planning, from the pensions you take to the gifting allowances you use, is vitally important. We can help you to manage your income in retirement and your IHT liability. This will give you peace of mind and confidence that your loved ones are looked after.

The other important thing you can do to relieve stress for those you leave behind is to put a will in place.

It is the simplest way to ensure that your wishes will be adhered to and this is especially important where your wishes don’t align with the rules of intestacy. These apply when you die without a will and could mean your estate is distributed in a way that you wouldn’t have chosen.

If you want to ensure your estate goes to a cohabiting partner you are not married to, or stepchildren, for example, a will is vital.

Having a will in place could also make dealing with your estate less expensive for those you leave behind, while also preventing family disputes at an already difficult time.

Remember too that life events can change your priorities and could result in the need to amend your will. Having one in place is important, but so too is ensuring it is up to date.

Get in touch

Please get in touch if you’d like to discuss any aspect of your estate planning, including managing a potential IHT liability or the impact of the government’s “tax day” changes.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.