A recent YouGov poll suggests that half of over-55s will opt for a living inheritance over leaving wealth to loved ones in their will.

With Inheritance Tax (IHT) thresholds frozen and government tax receipts rising, it isn’t difficult to see why the traditional inheritance on death is losing popularity.

But is leaving a living legacy a good idea?

Keep reading for three reasons why you might opt to give your wealth to loved ones now.

1. IHT receipts are on the rise

The Telegraph recently reported that the Treasury’s IHT take hit £6.1 billion last year. The 14% increase from the previous year marks the largest annual rise since 2016 and the tax take looks set to rise even further.

In his March 2021 Budget, then-chancellor Rishi Sunak froze the IHT nil-rate band (£325,000) and the residence nil-rate band (£175,000). The freeze is set to remain in place until at least 2026.

The Office for Budget Responsibility (OBR) recently forecast that total IHT receipts over that period could total £37 billion.

The freeze was brought in to help claw back some of the government’s coronavirus borrowing but giving while living could allow you to lower your potential IHT liability.

2. A living legacy could lower your IHT bill

With IHT receipts rising, you can use giving while living to lower the potential liability you leave behind.

Potentially exempt transfers

You can make gifts of any value during your lifetime, known as “potentially exempt transfers” (PET). The transfer usually falls outside of your estate – and is thereby tax-free – if you survive for seven years after making the gift. This is known as the “seven-year” rule.

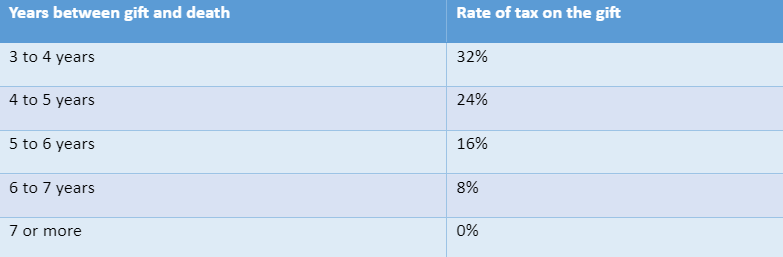

IHT is payable at 40% but the tax rate reduces on a sliding scale, depending on how long you survive after making the gift, thanks to “taper relief”.

Source: HMRC

Simply put, giving an inheritance earlier in your life means you are more likely to live for a further seven years, rendering the gift tax-free.

Gifting exemptions

You can use certain HMRC exemptions to give gifts that are free of IHT from the moment you make them. These exemptions allow you to give money to loved ones now, while lowering the value of your estate for IHT purposes.

Exemptions include:

- HMRC’s annual exemption allows you to gift £3,000 each year spread across as many gifts as you like. The limit applies to you alone and can be carried forward for up to one year.

- The normal expenditure out of income exemption means you can make regular gifts (such as into a loved one’s investment or savings account) as long as you can prove the gift is made from income and doesn’t affect your standard of living.

- Small and exempted gifts of up to £250, for birthday or Christmas presents, for example, can also be made tax-free.

Gifts between partners

Gifts to your spouse or civil partner always fall outside of your estate for IHT purposes so can be made tax-free.

3. There are non-financial benefits too

If you plan to leave money to loved ones, you could be providing them with increased financial security or the chance to make lifestyle choices that would’ve been otherwise unaffordable.

There are two main, non-financial benefits to leaving a living legacy.

Seeing the difference your money makes

Giving while living means that you will still be around to witness the difference your money makes. Your hard-earned wealth could provide a family holiday for loved ones, a first step on the property ladder or a debt-free entry into adult life.

If your money is going to help create lifelong memories for your loved ones, why not be there to share those with them?

Giving money when it is most needed

Waiting until death to pass on your wealth might mean that your loved ones are already well into successful careers, with families of their own.

Passing on a living legacy could mean that the money you give arrives at the time your loved ones need it most. For adult children looking to start a family or get onto the property ladder, the wealth you intend to pass them could be much needed right now.

Get in touch

There are many different ways to pass on your wealth to loved ones. With decades of experience, our Chartered Financial Planners have the expertise to help you decide the right way for you. If you have any questions, please get in touch and speak to us today.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Taper relief only applies to gifts above the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.